Automation tools for conducting trading on financial markets have existed for many years and have become quite popular with retail investors around the world. At first glance, such tools offer investors an advantage in finding price movements or patterns to earn a profit, but the use of such trading tools often comes with increased risks for the investor.

Such 3rd party automated trading tools are often referred to as robots, advisors, algorithms and the like. Popular trading platforms, such as MetaTrader have entire communities of traders and programmers who build so-called Expert Advisors – software that runs on the trading platform and conducts automated price analysis and trading.

Other broker platforms may have similar software that works on top of the existing platform infrastructure to help investors automate their trading strategies and market analysis.

Both novice and experienced traders need to keep in mind that using such trading tools can present additional risks for investors apart from possible losses incurred while trading. We cover some of these risks below.

Traders should carefully consider the methodology used by trading tools that are offered by brokers or 3rd parties to make sure they align with the investor’s trading goals, risk appetite and frequency of trading. For example, you should carefully study how the trading tool you want to use analyzes market data, finds trade scenarios and how it executes orders on your behalf on the trading platform. The latter is especially important in order to understand when and how the trading tool will be conducting trades for the user in a live environment. It is important to understand these details in order to analyze the amount of risk a trader is willing to tolerate when using 3rd party trading tools. Furthermore, the trader is responsible for understanding any settings or set up instructions required for the trading tools prior to using them in a live market.

Traders must also understand that any profits or, more importantly, losses incurred on their account while using 3rd party trading tools are their sole responsibility. Most brokers will include clauses in the agreements governing retail client accounts absolving them of any legal responsibilities for trades or analysis conducted using such tools. Before beginning to use a 3rd party trading tool, carefully consider your risk appetite and the funds you are willing to lose, should the trading tool not work in your favour.

Investors must understand that the resolution of disputes involving losses incurred from the use of automated trading tools often rests on the legally binding agreements between traders and their brokers. As mentioned above, such agreements almost always indicate that any trading results achieved using such tools are the responsibility of the trader.

Furthermore, according to the Financial Commission’s Rules & Guidelines, such disputes may be rejected by the organization, in cases where losses incurred by the trader were the result of using tools provided by 3rd party companies or trader communities and not directly by a broker member of the Financial Commission.

Given all these factors, traders must carefully consider if any 3rd party trading tools or software align with their trading strategy given the risks described above and the low probability of achieving success in any type of dispute that may arise from such automated trading.

According to the latest statistics from the world’s major financial regulators, investors and traders are becoming victims of financial fraud and scams on a large scale. Oftentimes people are approached by unknown persons offering investment advice and promising hefty returns, while other times folks react to an advertisement and stumble upon websites offering investment or managed trading services and promising similar high profits. In order to avoid becoming a victim of financial scams, we’ve put together the following guide to help you stay protected and make informed investment decisions.

Social Media

Many fraudulent investment schemes will use social media to target prospective victims. Many times social media users will be approached by an unknown individual offering them investment advice and services. Other times a friend may recommend someone they met online that has offered good investment returns. Such individuals will claim to be knowledgeable or professional money managers, or investors themselves and may provide records of past investments to justify their services. Likewise, such individuals will most often offer the potential investor to open an account at a brokerage or investment firm.

If someone approaches you through social media offering investment or managed trading services, always keep in mind that offering such services requires a license in most countries around the world from an official government regulator, such as FINRA in the United States, FCA in the United Kingdom and ASIC in Australia. If an individual provides you a copy of such a license, make sure to visit the website of the regulator and check that the license is valid (not revoked, suspended, terminated or fake).

If the individual is asking you to open a trading or investment account at a financial firm, ask the individual to provide proof of their affiliation with this company – are they an employee, an introducing agent or an affiliated party? If the person cannot verify their relationship with the financial firm, it is possible they may not be acting in your best interests. Be sure to search the individuals’ name and company name in a search engine to find any possible reviews or feedback about the parties from other investors, regulators or associations. Negative feedback relating to loss or theft of funds from previous investors or financial regulators is a warning sign. Likewise, it is important to study the website of the company for information that is required to be disclosed by regulators. For more on this topic, see the next section of our Guide.

REMEMBER:

How to Spot a Scam Website

Besides being solicited online people can stumble upon or react to a marketing message from a company offering investment or managed trading services through an online website. Investors or prospective traders should use caution before making a decision to open an account or send their funds to such websites. It is important to first study the website and make sure that it contains some key information that helps differentiate legitimate companies from possible scams.

Here’s what investors should ask themselves when analyzing an investment service website:

If you answered “no” to any of these questions while studying a website offering investment services it is possible that the website could be a scam. To make sure that company registration and contact information are genuine, you can contact the company at their phone, chat or email to get a response. Likewise, using an online map service can help determine if the address listed does indeed represent a building with offices or other structure typically used for business purposes.

Funds Withdrawal Policies

Another way to evaluate the risks of making an investment with a particular financial services company is to study their policies regarding the withdrawal of customer funds. Most if not all reputable companies will let a customer withdraw their funds from an investment or trading account almost immediately during normal business hours or within one or two business days without any preconditions. Furthermore, the customer is usually notified electronically as the withdrawal process is completed.

If you find that the company you are interested to invest with or send funds to has a policy that requires you to either make an additional deposit, pay some form of tax or a percentage of your withdrawal amount in order to process the transaction of returning your funds to you, then it is possible it could be a scam.

It is important to understand such details before opening an account or sending funds to the company, as it is very difficult to try and recover funds once they have been credited to the company or website in question.

REMEMBER:

If you have additional questions or doubts about an investment or managed trading opportunity you can rely on some additional online resources for help. You can check our organization’s Warning List and Check Your Broker directory to find out more information on known scams and reputable companies. If you are looking for a broker to trade with on your own, you can find unbiased reviews and ratings of reputable brokers here.

With the recent Covid-19 global pandemic causing widespread market volatility across all asset classes, the Financial Commission reminds traders of the sensible ways to protect their account using practical ways of risk management.

During unprecedented global shocks and market events, traders should be aware of the following:

In order to protect your trading positions, use sensible ways to manage risk in your account:

Price Gaps

During the recent market turmoil, there have been numerous price gaps in different financial products, including currencies, oil, and equities. Such gaps often happen without any warning or analytical information to suggest such an event will take place. During such market events, the prices quoted for executing trades and orders can vary significantly from one tick to the next and lead to an order not being filled or filled at a worse or better price than intended.

In order to avoid risks of price gap movements, it is suggested to reduce the size of your trading position before market closing – for example, overnight rollovers for such CFD products, as oil contracts and over the weekend. During increased market volatility, the opening price following the resumption of trading can often be far away from the previous closing price. By reducing your trading position, you can reduce the risk of losses due to such price discrepancy. By closing positions entirely before market close over the weekend traders essentially remove all risks of adverse price changes at market open the following business day.

Using Stop Loss Orders

A great way to limit downside risk to open trades is to use contingent orders, such as “stop-loss”, to reduce the negative exposure should the price of the instrument you are trading go against you. Such order types are commonplace on all popular trading platforms across FX, CFD, and equities brokers. When using stop-loss orders traders are advised to study their broker’s policy on stop-loss order executions, as such orders may in certain volatile market situations be triggered and filled at a price that is different from the requested price in the order. In such situations, the trader’s order can be filled at a worse price than requested. Your broker’s trading policies will explain how the broker deals with such situations so you can plan your trading strategy accordingly.

Closeout or Liquidation Level

If you’re trading on a Forex or CFD trading account with leverage, your account will have a “close out” or “liquidation level” – that is the level of margin in your account, at which the broker will automatically close all of your open trades and orders because you do not have any more free margin to keep positions open. Brokers can have a liquidation level of 150%, 100% or lower, such as 50%. This means that if the % of available margin level (i.e. net equity/required margin) in your account falls below this critical level, your traders/orders will be liquidated immediately. To reduce the risk of liquidations, we recommend that you know your closeout/liquidation level on the trading account. By calculating how low your available margin balance can go you can then understand how much more risk you can take on your open or pending trades and orders. Knowing how much available margin you must maintain at all times on your account will help you make better risk management decisions by incorporating the other risk factors above.

Our official website offers more trader education and important tips for all so you can make informed decisions concerning your broker and your trading account.

Why do Forex Binary Options have Short-term Expirations?

The price dynamics of the forex market has often been characterized by both academics and practitioners as a random walk. This means that the exchange rate of a currency pair has an equal probability of an upward and downward movement, such that the expected change in the exchange rate (at least in the short term) is equal to zero. Consequently, the average trader should not expect to be able to predict the future direction of exchange rates in a consistent manner.

Putting this together with the asymmetric payout of binary options, traders are at a disadvantage when it comes to predicting the short term price movement of exchange rates. It is because of this disadvantage that binary options have short term expirations, which makes it very hard for the trader to predict the direction of exchange rates within a few minutes or hours.

The Bid-Ask Spread

The spread between the bid and ask quotes offered by the broker is an additional cost that the trader must be aware of when dealing with binary options. In general, a broker quotes two prices for an exchange rate: the bid price, which is the price at which the broker will buy an asset at, and the ask price, which is the price at which the broker will sell at. For example, a broker might quote EURUSD at 1.15000 / 1.15004, which means that a trader can buy 1 Euro for 1.15004 USD and can sell 1 Euro for 1.15000 USD.

In the context of binary options, the bid-ask spread is often included in the marking of the option.

As such, a trader who buys a binary call option will have essentially bought into the option at an ask price of EURUSD 1.15004. If we assume that the EURUSD exchange rate does not change and the spread remains the same until the option expires, then the option is closed (or marked to market) at the bid price of 1.15000, which is lower than the initial ask price of 1.15004. This means that the binary call option expires at a loss for the trader.

Consequently, the spread is an additional implied cost that the trader should take into account when trading binary options. During times of low market volatility and during normal trading hours, the spread is expected to remain the same. However, when market volatility is high and during times near the opening and closing of the market, the spread can widen significantly, thus putting the trader at a greater disadvantage.

How can Traders Minimize the Disadvantages Inherent in Binary Options Trading?

As we have mentioned above, the asymmetric payoff of binary options, coupled with the random walk nature of exchange rates in the short term, and the bid-ask spread charged by the broker render binary options a risky investment. However, a trader can take certain measures to minimize the risk associated with binary options trading.

First, traders should conduct proper due diligence and research about the broker they are trading with. In order to minimize the disadvantage associated with an asymmetric payout, traders should select brokers who offer the highest percentage payout.

Second, traders should also check the quoting and marking policy of the broker. Some brokers state that they charge a fixed bid-ask spread, while others state that they have a floating spread. The latter is riskier especially when the market is turbulent, which often implies that the spread will widen.

Third, spreads are typically much wider at the start and end of a trading session. Due to this reason, traders should avoid trading options during these times in order to minimize the likelihood of widening spreads.

Fourth, given the random nature of the foreign exchange market in the short term, traders who possess some predictive skill should opt to trade binary options that have the longest time to expiration. This would give the option enough time to cover the spread as well as move in the direction that they have predicted. The shorter the time to expiration, the less likely it is that the exchange rate will change fast enough to cover the bid-ask spread and reach the target price of the option.

By following the above recommendations, traders would be able to minimize the risk associated with binary options trading and increase the likelihood of having profitable trades.

Binary options are popular among beginner traders because they are very easy to understand. A binary option allows the trader to bet on whether the price of an asset will be above or below a certain target price (usually the current market price) at a future time. If a trader expects the price of an asset to increase, then they would buy a binary call option, which would result in a gain if the price of the asset rises above the target price. On the other hand, if the trader expects the price of the asset to drop, then they would buy a binary put option, which pays off if the price of the asset falls below the target price. The payout from a binary option is either a fixed amount in case the prediction by the trader is correct or nothing at all if the prediction is wrong. As such, these options are also referred to as cash-or-nothing options.

Asymmetric Payout of Binary Options

The reason why binary options are popular is because the payout typically ranges between 70% to 90% over a range of few minutes or hours, which makes them very enticing for a trader who wants to earn quick profits. However, binary options have a negative expected return because the payout is asymmetric. This asymmetry puts the trader at a disadvantage.

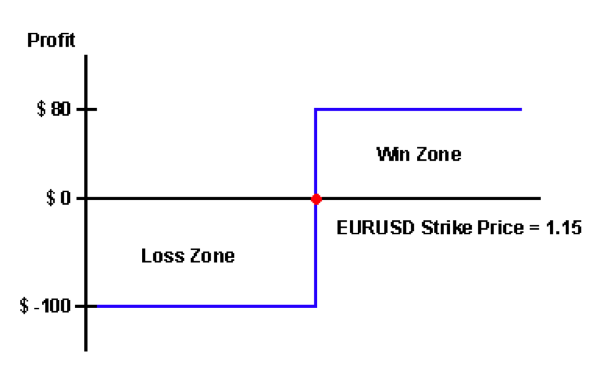

To illustrate this point, consider a trader who expects the EURUSD exchange rate to rise over the next hour. The trader decides to buy a binary call option for a cost of $100 and is guaranteed an 80% payout if their prediction is correct regarding the EURUSD rate, but loses everything if the prediction is wrong. If the target (strike) EURUSD price of the binary call option is 1.15 then the payout from the option for different ending price scenarios can be illustrated as per the chart below.

If we assume that the price of the EURUSD exchange rate has an equal probability of rising or falling, then the expected return can be calculated as follows:

Win = $100 x 80% = $80

Lose = -$100 * 100% = -$100

Expected Return = (Win x 50%) + (Lose x 50%) = -$10

In other words, a trader is expected to lose an average of $10 on each bet that is made.

For this game to be fair, the outcome of a win scenario should be equal to the outcome of a lose scenario, which means that a trader needs to be able to win at least 56% of the time to make the expected outcome equal to zero (i.e. $80 x 56% -$100 x 44% = 0).

While bonuses and incentives offered by brokers have become a common practice, we bring your attention to the fact that not all bonus programs are created equal. Trading bonuses can be difficult to understand for a new trader or even experienced trader and we advise customers to review any bonus program or promotion before entering into one.

Each bonus program offered by a particular broker should have terms and conditions that clearly indicate the way the bonus or incentive structure will work. Given our industry experience, below we present some important things to look for when choosing a bonus program from a broker.

Review the Terms and Conditions

The most important thing that a trader must do when deciding to participate in a bonus program is to evaluate the terms and conditions of the offer. Only then can a trader make an informed decision on whether the bonus structure and amount is suitable for him.

The terms of the offer should present to the trader the scenarios in which a bonus will be granted and in what way the bonus will be given to the customer. This may include a cash deposit into the customers trading account, a reduced spread to trade on or a physical gift that can be mailed to the customer.

Keep in mind that the scenario should give a clear example of how the bonus can be achieved. Make sure to check the start and end date of a bonus promotion to make sure that you can participate or complete any trade requirements in the allotted time. Likewise, if the promotion includes a trading requirement, you should evaluate your costs of achieving that trade requirement with your trading goals. It may turn out that your trading costs, including spread paid ultimately is higher than the bonus amount you earned.

Amount of bonus offered

We often see brokers offering very large bonuses to customers either as a cash value or as a percentage of their deposit. Often times, the bonus is structured around the customer’s first time deposit with the broker. In such cases, we advise clients to evaluate the terms and conditions before making a decision to enter the program.

Often times, high bonus amounts are not eligible for withdrawal by the customer. In such cases, you can receive the bonus on your account, but you can only use these funds for trading and cannot return them to your bank or card account. Again, the terms and conditions should always give you a description of how the bonus can be used.

In certain instances, high bonus amounts, especially those that are up to 100% of a customer’s deposit will have restrictions that do not permit the customer to withdraw any funds from their account until a certain amount of trading volume is conducted. In such cases, the trading volume requirement is significantly high. Traders using such bonus programs often find that they either do not have enough funds (including the bonus) to complete the trading requirement or incur losses during trading towards fulfilling the requirement and are forced to deposit new funds into their account. These types of aggressive bonus offers are likely to be detrimental to the customer, rather than a benefit.

Also keep in mind that a large bonus deposited to your account will likely increase the amount of funds you have to trade, especially if you are trading with leverage. In this case, while you have more funds to trade with and can open bigger market positions, you must always be aware of the risks of leverage trading. If you open a big position, you must maintain a margin requirement on this position. It is likely that a market move against your position will cause your position to be liquidated quicker than had you have a smaller position and employed proper risk/reward strategy.

A similar, but more risky bonus promotion can contain an increase in “buying power”. These types of offers will allow the bonus amount to be deposited into your account only to increase the maximum position size that you can open by increasing your account balance, but when calculating the margin requirement for a position, this bonus amount will not be counted. As such, you can open a larger position, but you cannot withstand a larger loss in your account before a margin call. Trading with this type of bonus significantly increases the risk of losses for customers.

Calculating a bonus

The broker’s bonus promotion should also provide you with a simple way to calculate what your bonus amount is or will be in the future. More often these days bonuses are offered as a percentage of your initial deposit. In such cases, you should keep in mind that the bonus calculation will only include new funds that you have deposited and not those that you may have transferred from an existing trading account at your broker or an account at another broker. Likewise, some bonus programs will not count any subsequent deposit you have made towards a bonus calculation.

Some bonus programs also have a tiered structure, meaning that the amount you will receive in bonus increases as you deposit more funds or conduct more trades. We advise you to be careful when evaluating such programs and keep in mind your financial and trading strategy. You should be aware of how much money you can afford to invest in trading and how many trades you are willing to conduct based on your risk profile. As we mentioned above, sometimes the costs associated with completing the required number of trades is higher than the actual bonus amount you receive.

Where to get help

We advise you to carefully evaluate a bonus program based on your trading goals. If you have any questions about a bonus program, you should contact your broker directly before making a decision to enter into the program.

You can also contact the Financial Commission with questions as we offer assistance to traders free of charge.

|

How bitcoin evolved from post-crisis fintech innovation

The trillions of wealth wiped from the global financial system due to the Great Financial Crisis (GFC) triggered by a cascading failure linked together by systemic risk caused by derivatives reached $22 trillion, according to a report by the U.S. government accountability office.

In the last ten years since the GFC, a multitude of alternative asset classes emerged across the globe, with digital assets representing the newest breed with unique genetic characteristics and traits not seen in prior generations of technology.

Bitcoin is an example of the largest cryptocurrency to date, in terms of market capitalization and network size, and below are some of the drivers that helped propel this newly maturing cryptocurrency and the broader crypto-industry emerging since then.

Low rates shifted interest into fintech-powered alternatives finance

The low-interest rate environment that persisted as a result of the GFC globally has caused many institutional investors to seek higher yields in alternative markets.

This influx of [smart money] capital into alternative investments and alternative asset classes (i.e., non-bank products) helped fuel the emergence of new financial products thanks to innovative financial technology (FinTech).

The Era of P2P Crowdfunding and Social Networks

As investors sought higher yields in alternative markets, Fintech companies applied innovative experimentation with new financial products across industries to capture existing and expected demand for alternative financial products.

Venture Capital (VC) and private equity (PE) investments in FinTech companies have helped accelerate these trends across various industries as global markets for alternative finance continued to mature. The emergence of peer-to-peer (P2P) technology has coincided with trends in payments apps, social networks, as well as social trading, and crowdfunding.

The emergence of a new Crypto taxonomy of financial products: digital assets

During the midst of the GFC in 2008, a document was published titled: “Bitcoin: A Peer-to-Peer Electronic Cash System,” authored by the pseudonym “Satoshi Nakamoto.”

This white paper for Bitcoin described the use of cryptographic proof – to replace the need for any trust between peers in a network by using cryptography as a validation mechanism thus relinquishing the need for any trusted third party or central authority.

Bitcoin

Bitcoin is a digital currency that runs on a distributed peer-2-peer (P2P) decentralized network on the global internet supported by its community of users. Users transact bitcoin between two unique public addresses, one belonging to the sender and the other to the receiver, and a small transaction fee is paid by the sender to miners within the network who help process the transaction (more on that below).

Being decentralized and public helps bitcoin to maintain its distributed network which consists of copies of its ledger hosted by users in what is called a node. The current size of the bitcoin ledger (bitcoin) is currently nearly 145 gigabytes and growing each day, and this represents the amount of hard drive storage needed for anyone to run a full node.

Bitcoin nodes

Hosting a full node, which can be done by nearly anyone, helps to support and run the bitcoin network. By running a full or partial node, users contribute to the collective network of nodes which act as a checkpoint for the entire ecosystem as each node contains the entire ledger with an immutable history of transactions that have already been deemed irreversible (more on how transactions are processed and mining below).

Bitcoin mining

The potential supply of bitcoin is limited due to the code used in the protocol that bitcoin must follow without exception (not including forks, more on that later). There can never be more than 21 million bitcoins created, and there are already nearly 17 million in existence.

Bitcoins are created based on a multi-step process where user-operated/owned computers are dedicated to trying to guess a nonce, which is a sufficiently large arbitrary number that is generated randomly and with increasing difficulty to find. The increasing mining difficulty together with a limited potential supply creates a narrow channel to keep inflation contained, compared to traditional fiat currencies such as US Dollars or Euros (where inflation rates are attempted to be controlled by a central bank).

Mining Difficulty

The difficulty rate to be the first to find the next nonce – to be rewarded the bitcoin produced in the next block – is so high currently that entire factories of interconnected servers running specialized computer processing (mining) hardware are dedicated to achieving the required hashing rates to make mining worthwhile.

Network incentives: Mining and Network Fees

Each time a nonce is correctly guessed, a new block is created, and the correct nonce number becomes hashed or connected to the prior block, acting as a liner chain between the prior and current block.

Miner Rewards

The miner or pool of miners that guessed the correct nonce is awarded the bitcoin amount contained in the newly minted block, which is currently 12.5 bitcoin per block.

Users who participated in mining the block also compete to add recent bitcoin transactions made between users transacting bitcoin in the network into the newly mined block to verify them.

Miner Fees

Senders of bitcoin pay a network fee to miners and miners are incentivized to include these transactions in new blocks to earn the network fee paid by the sender of each bitcoin transaction.

This structure supports the flow of capital within the bitcoin network while keeping miners interest vested in supporting the ongoing maintenance of the network which in turn supports more users within the network which then again returns value to miners in the form of transaction fees.

Bitcoin cyclical price growth

The cyclical process that bitcoin’s network structure follows is similar to economic cycles. Bitcoin can be thought of as an economy and was literally in the top 40 globally when comparing its M1 money supply, as of November 2nd, 2017 when it’s market cap surpassed $110 billion dollars after the price of 1 bitcoin reached $7200.

Many consider bitcoin to be in a price bubble, yet when examined over its historical price action, bitcoin has already had numerous bubbles where its price inflated and deflated over nearly the last nine years.

Passive investing in cryptocurrencies

Despite rebounding higher in its last wave (current bubble) if the underlying drivers that are causing it to become accepted continue, some analysts believe it could reach $1million per bitcoin in just a few years, while others believe it will fail or be superseded by next-generation crypto networks with more advanced survival traits.

These challenges make it very difficult for even the most passive investors as maintaining a diversified portfolio in cryptocurrency markets may require very active rebalancing as the rankings of digital assets are constantly changing (when comparing the top 50 cryptocurrencies for example over just the last few months).

Social crypto networks

Just as FaceBook – which is not currently a crypto network – needs to maintain users to monetize their attention as the currency in its social network by charging marketing firms to display ads to users, the size of a crypto network is a major driver of its price valuation. Without any underlying users, the network wouldn’t be of value to anyone.

However, with FaceBook the “currency” in its network is paid to FaceBook from marketers, and users are not able to participate in those benefits beyond the utility derived from using the Facebook platform. Public crypto networks that are inherently P2P may eliminate the need for a middleman, but maintaining the network size and growth rate is the key to its sustainability, utility and any resulting valuation.

P2P transfers without the need for a trusted 3rd party

While the need for trusted third parties has been replaced in crypto networks such as bitcoin, there are still inherent risks such as ensuring there are enough users to generate enough transactions to incentive enough miners to support the network and the price of the digital asset that helps fuel it.

Network cycles

Bitcoin is no exception, and just like any crypto network, there must be enough users in the bitcoin network to generate enough transactions, to support the demand (price) while incentivizing miners to process transactions and supply mining newly minted bitcoins. Bitcoin’s network follows a cyclical process and is comparable to other natural economic cycles within global marketplaces across industries where commerce takes place.

Private-key/Public addresses

All bitcoin transactions are made between public bitcoin addresses where the respective holders of each bitcoin address own a unique private key connected to the respective public address (except for coinbase transactions which are created by miners when bitcoin is awarded from mining a block).

Public nature of bitcoin

While purchasing or mining bitcoin may come under the control of law, anyone is free to do the math to generate a nearly-unlimited number of bitcoin addresses for free using the open-source public code, and this can even be done off-line, ideally on an air-gapped computer to reduce the likelihood of a screen-recording or keylogging malware.

Therefore, safeguarding private keys is another challenge on its own and is where significant risk remains as lost funds – whether due to hackers obtaining private keys or users forgetting or misplacing their private keys – means that lost bitcoin is unrecoverable.

Private key = digital asset

Each private key is akin to a secret password that is fixed and cannot be changed, and the address owner must safeguard this private key as it is the sole backup to control their digital asset (unless the key is safeguarded by a 3rd party exchange).

Anyone who obtains access to your master private key, known as a recovery passphrase or master seed, can access your digital asset. Therefore, safeguarding private keys becomes of paramount importance to protect bitcoin from theft or accidental loss due to forgotten or misplaced keys as they are unrecoverable.

Elliptic Curve Cryptography

Master Private Keys are generated using an open-source computer code that uses complex math to generate very large random numbers that are subsequently used in a multi-step computational process (involving more random numbers) with each step independent of each other.

This process which incorporates Elliptic Curve Cryptography (ECC) helps ensure a level of security that complies with some of the highest standards of encryption making it nearly impossible or improbable to guess/hack/crack the private key.

Crypto assets such as bitcoin follow some of the highest standards of encryption currently available, combining elliptic curve cryptography (ECC) to generate public/private key pairs, and the Secure Hash Algorithm (SHA) for mining blocks (more on mining below).

Securing digital assets

SHA-2 was developed by the U.S. National Security Agency (NSA) and the SHA family including SHA-3 is widely considered one of the strongest forms of encryption (sufficient even for military and Government top secrets).

Although the SHA2 family of algorithms was patented by the NSA, they were later released under a royalty-free license on June 20th, 2007 and are today widely used on the internet.

Today, SHA-related encryption can be found in many common computer applications and services across the internet as it is used for authentication (encrypting/decrypting) access to secure online services from both commercial enterprises and in free open-source software code/applications.

Mnemonic Passphrases For Recovery and Control of Digital Assets

SHA2 is considered secure because the resulting private keys that are generated (in which case with digital assets like bitcoin follow methods like BIP32 or BIP44 and then are converted into an easy to remember passphrase of 12-24 words via methods like BIP39) have between 256-512 bits of entropy. Entropy is a rating of the inherent protection passwords have against collision attacks (i.e., accidental guess or hackers trying to crack via brute force).

However, the risk for users to safeguard those keys is an entire different responsibility and is where the significant risk lies because hackers could obtain those keys and access your digital assets as described earlier.

|

Best execution policy under MiFID adopts a multi-faceted approach that addresses, amongst other things, quality of execution, trading conditions extended to clients and the counterparty selection process. It also provides directions and guidelines on how best execution can be achieved.

The execution policy, set forth in MiFID II rests on several main pillars and I will briefly describe my findings on these below.

1. How many counterparties should a broker have? 1 or 5?

The broker may use a single counterparty as long as, by using this counterparty, the broker is able to deliver consistently best execution to its clients (Please note that this order execution should be supported by relevant data and internal analysis). If the broker is not able to consistently achieve best execution for its clients through one venue, then they should deploy multiple liquidity providers and report the top five counterparties by volume on an annual basis (see point #2).

“Investment firms transmitting or placing orders with other entities for execution may select a single entity for execution only where they are able to show that this allows them to obtain the best possible result for their clients on a consistent basis and where they can reasonably expect that the selected entity will enable them to obtain results for clients that are at least as good as the results that they reasonably could expect from using alternative entities for execution. This reasonable expectation should be supported by relevant data published in accordance with Article 27 of Directive 2014/65/EC or by internal analysis conducted by these investment firms.”

2. Reporting the top five trade-executing venues by volume

Under this best execution criteria rule, if a broker sends its order flow to other parties for execution, it should produce an annual report disclosing its top five counterparties based on the volume of client trades executed. The company should also be able to provide such statistics upon a reasonable request from the client.

“Article 64 Best execution criteria (Articles 27(1) and 24(1) of Directive 2014/65/EU)

In particular, when the investment firm select other firms to provide order execution services, it shall summarize and make public, on an annual basis, for each class of financial instruments, the top five investment firms in terms of trading volumes where it transmitted or placed client orders for execution in the preceding year and information on the quality of execution obtained.

Upon reasonable request from a client, investment firms shall provide its clients or potential clients with information about entities where the orders are transmitted or placed for execution.”

3. Document counterparty selection process

Brokers will be required to, both, create and retain a summary of their counterparty selection process as well as their criteria for defining best execution policy for their clients.

“a summary of the selection process for execution venues, execution strategies employed, the procedures and process used to analyze the quality of execution obtained and how the firms monitor and verify that the best possible results were obtained for clients.”

4. Conduct extensive due diligence on all potential counterparties, taking into consideration the industry expertise and market reputation of the counterparty in question.

Apart from obvious considerations in selecting a liquidity provider, such as pricing and execution, market practices, business model and other trading conditions, brokers should also evaluate intangibles like domain expertise and market reputation.

“In particular, Member States shall require investment firms to take into account the expertise and market reputation of the third party as well as any legal requirements related to the holding of those financial instruments that could adversely affect clients’ rights

Speed, likelihood of execution and settlement, the size and nature of the order, market impact and any other implicit transaction costs may be given precedence over the immediate price and cost consideration only insofar as they are instrumental in delivering the best possible result in terms of the total consideration to the retail client.”

5. Emphasis on Best Execution on a consistent basis.

MiFID II is now forcing brokers to take into consideration the multiple factors impacting trade execution, not just the price, by focusing the emphasis on the consistency of the overall client experience.

“least establish the process by which it determines the relative importance of these factors, so that it can deliver the best possible result to its clients. In order to give effect to that policy, an investment firm should select the execution venues that enable it to obtain on a consistent basis the best possible result for the execution of client orders”.

6. Collecting Market data

In order to prove best execution practices, brokerage firms will need to gather relevant market data to verify OTC prices, offered to clients, against the interbank market benchmark.

“As best execution obligations apply to all financial instruments, irrespective of whether they are traded on trading venues or OTC, investment firms should gather relevant market data in order to check whether the OTC price offered for a client is fair and delivers on best execution obligation.”

While the number of changes to requirements might seem overwhelming, in my opinion a lot of these can be addressed by working with reputable and experienced partners, those that are experienced and can cover these new requirements from all angles and, in turn, provide the fair and completely transparent execution for traders. For some guidelines on the appropriate questions to ask a potential liquidity provider during the due diligence process, please click here.

To learn what other high-impact changes MiFID II brings, download a list here

August 3, 2017: Financial Commission, a leading External Dispute Resolution (EDR) organization, operated by FinaCom PLC, servicing online Forex and CFD brokerages and technology providers within the financial services industry, today announces support for the recent findings in a report published by Traction Fintech.

A recent article was published by regulatory compliance specialist Traction Fintech, which examined differences between over-the-counter (OTC) leveraged derivatives such as contracts for difference (CFD) including forex across four jurisdictions.

The full report referenced in the article was authored by James O’Neill, a director of the Australian-based broker ILQ and compared requirements related to client money handling, fair market pricing, leverage, and capital requirements across Australia, Cyprus, the United Kingdom (UK) and the United States (US).

Financial Commission supports the need for jurisdictions to improve rules surrounding client money handling and fair price discovery methods (such as the Global FX Code) to help uphold best execution at global forex and CFD brokerages, among other topics explored in the report.

Comparing Four Major Jurisdictions

A table in the article, which can be seen below, provides a high-level overview of the differences across each country and comes shortly after Australia’s government revised legislation under the Corporations Act related to how trust accounts are handled aimed to help safeguard client funds.

|

Fair pricing and execution

The author of the report noted that Cyprus and Australia underperform in ensuring fair and transparent pricing by brokers, compared to the United States and the United Kingdom, and suggested that Australia consider specific rules to address its mandate under rule 912(1)(a). For example, the current definition of market making in Australia is very general and would make it hard to contest asymmetric slippage in terms of infringing on the mandate.

The author added that the obligations in Cyprus’ regulations – namely article 36 of the Investment Services and Activities and Regulated Markets Law of 2007, go beyond the Australian equivalent when it comes to asymmetric price slippage when executing client’s orders (although both trailed behind the US and the UK).

In terms of comparing differences in how customer monies are handled in each jurisdiction by authorized brokerages, the author argued some of the advantages and disadvantages of allowing brokers to add capital to help buffer client’s accounts to avoid a shortfall.

Account buffering and trust account rules

For example, in the case of trust accounts in the US where buffering is permitted – a broker can commingle its own money into client’s accounts to help maintain excess capital and avoid a shortfall in the required margin (i.e. during periods of high volatility).

The author argued that commingling a broker’s own money into clients trust accounts could blur the line between the funds belonging to the trust and that of the broker’s money in the case of insolvency.

Meanwhile, brokers that can use client money to hedge and for margining purpose endorses the idea that not all brokers who are the counterparty to a client’s trade are acting as market-makers.

Furthermore, permitting the use of client funds for hedging and margining could blur the line between proprietary trading and the hedging that is common for a matched principal. The author also pointed out the systemic risk that exists with client segregated accounts when the funds are pooled together in the same account, and how this could be remedied if it was required that each client’s funds be held in a separate bank account.

Cathie Armour, a Commissioner at the Australian Securities and Investment Commission (ASIC) commented regarding the rule changes: “The amendments to the client money regime made in the Bill have strengthened the protection of client money that is provided to retail derivative clients. Doing so will help to increase investor confidence in the Australian financial system.”

Sophie Gerber, Director of Traction Fintech commented in the article, “This has been a very divisive issue in the industry. What may have been a more beneficial approach to this issue would be to have disallowed the use of the Corporations Act provisions for using client money for margining/hedging etc. with related parties and also prohibiting the payment of any form of conflicted remuneration in these relationships. Time will show us whether these reforms have or have not benefited the industry, I think, unfortunately, in this case, the retail client will not see any benefits, and over the next few years the outcomes will be reduced competition and increased costs.”

The author noted that despite the rule revisions client’s money is still pooled in the same bank account and not protected from counter-party risk in the case of broker insolvency. He added how ASIC’s prohibition of allowing a buffer contrasted with other jurisdictions where maintaining excess capital is required for instance in the US.

Leverage

As leveraged forex and CFD trading are done from a margin account, the minimum margin requirements often vary from broker to broker with a wave of restrictions in recent years reducing the maximum leverage that can be offered in different countries.

The author explained that leverage is often blamed as the cause for clients’ losses, and while such restrictions have been put in place in many major jurisdictions, the UK has yet to put in place a cap. And while high leverage has been appealing for many traders, in jurisdictions such as Japan, a reduction of leverage doesn’t appear to have hindered its retail forex industry, as lower leverage may have instead helped it become a more accepted asset class for household investors.

The article cited an extensive list of industry news articles including announcements from regulators, to see the full article click here.

If you are trading in the forex market, then you are probably wondering how well your broker is executing your orders. And if you’re not wondering this, then maybe now is the time to start being inquisitive.

Unfortunately, brokers do not provide their clients with tools that confirm the execution quality of orders. This doesn’t necessarily mean that traders are given poor performance, but it does not confirm the opposite either.

In a decentralized market such as Forex, there is no single price available for everyone, and the quotes of market makers may differ from one another. In this regard, the average trader does not have the opportunity to assess the quality of execution, except to independently analyze the prices of different brokers at every point in time. Without the correct technology, this is a time consuming and difficult task.

But now there is just such a tool! Introducing VerifyMyTrade, an independent data repository that provides post-trade analysis of order execution for Forex transactions.

As expected, after the launch of the service the developers received a lot of feedback, both positive and negative. Many financial service providers agreed that this tool creates the ground for disagreement because it may lead traders to draw inaccurate conclusions about the quality of order execution. In fairness it must be said that this service cannot guarantee 100% accuracy of performance evaluation, but at least it provides some general indication of correctness.

At the same time, almost all those who responded supported the initiative because it really seeks to shed light on the process of pricing in the forex market. I absolutely agree with all the arguments and I want to explain why. Let’s introduce an example of two mobile users in one city. The first pays $ 100 per month and the second only $ 80. Many people might think that the first one overpays. However, can one make a comparative assessment without a detailed estimate of the quantity and duration of calls, as well as other options available in the contract? No, this simply isn’t impossible. In this respect the Forex market is no different; without understanding at what moment a trader concludes deals and what volumes, it is impossible to accurately assess the quality of performance. However, we all understand that in any market there is always a realistic price range within which the purchase of goods or services should not cause any surprise to the consumer.

From the above example I suggest looking at VerifyMyTrade from the perspective of what the service is trying to achieve: Firstly, to determine whether the price received from your dealer is out of range when compared to prices received from other dealers. Secondly, to show how competitive the pricing was in comparison with the prices of other market participants – a factor that is dependent on many factors; as shown in the cell phone example above.

Let’s have a look at the real problem faced by dealers and traders every day. In the overwhelming majority of cases, traders only recheck the execution price of loss-making trades. When one makes a loss, it is human psychology dictates one to go and check whose fault it was. We are convinced that there was an error, and that somebody else was at fault!

What does the trader do in this situation?

|

As a rule, he looks at the price of execution of his trade, and then looks for a dealer whose price at the time of execution was more beneficial to the executed trade. The problem is that within the structure of a decentralized market, the probability of finding a more beneficial price is very high, and on this basis the trader submits a claim to the dealer. |

What does the dealer do in this case?

|

The dealer reminds the trader of the decentralized nature of the forex market, highlights the legal terms and conditions according to which the dealer has the final say in determining the market price! That is it, the dealer does not even want to enter into a dialogue about the availability of a better price somewhere else |

Problem – Conflict of interest

|

From this moment on the disagreements begin. Only an independent third party such as the Financial Commission is capable of judging such cases. Despite signed the legal documents, the trader sees only loopholes and biases and considers himself deceived. He no longer wants to listen to any arguments of the dealer and believes that the contract is structured in such a way as to give the dealer absolute legal power for all occasions. |

Solving the problem at the stage of its occurrence

|

An educated trader is a loyal customer. VerifyMyTrade gives traders an understanding of what a decentralized market is before he independently comes to some conclusions and lodges a claim. By providing traders with a tool for analyzing the quality of their own traders, the dealer declares transparency and commitment to honest business. The client will then learn that price execution does not exist only as “correct” or “incorrect”, but with many varying options and factors in between. As a consequence, even if an execution problem is found the client will look at this as an error rather than as malicious intent. |

Position of the Financial Commission

The collective global foreign exchange markets are undergoing a gradual shift at the highest levels that should bring greater integrity for participants including major dealers and individual retail traders in the months and years ahead.

Meanwhile, regulators are collaborating across borders on efforts such as the global fx code to help standardize best practices for major dealers and banks when it comes to fair and ethical dealing at the interbank level.

What triggered these changes?

The developments to reform the foreign exchange markets come on the heels of major investigations (recent and ongoing) of FX market price manipulation at some of the largest banks and dealers in recent years.

The Global FX Code was created to bring a standardized approach to best-practices in the FX Markets to help ensure best-execution while preventing market price manipulation, among other expected benefits of the code.

The effort was organized through the Bank for International Settlements (BIS) under the Foreign Exchange Working Group (FXWG) and in collaboration with the others across numerous regulatory bodies and the Federal Reserve of New York.

The first phase of the code launched softly during the middle of 2016, allowing firms to voluntarily adopt its code of conduct rules, while the second edition of the code is set to update during the first half of 2017. The code is like a giant pilot program, helping regulators and participants gather collective feedback to improve future iterations.

Progress at the interbank level

Already banks and some dealers are beginning to state that they will only trade with other dealers that adhere to the code. This is an indication of its positive effects already, and something that regulators will be surely gauging as this pilot program gathers feedback from the industry during its first year in voluntary operation.

One size fits most

However, if financial market regulators try to create a unified set of rules to govern the origination and dissemination of FX prices as well as the execution of orders against prevailing market prices, then the Global FX Code will be a good place to start reviewing such data.

Already regulators such as the FCA have numerous programs underway including after recent studies that the FCA conducted on its members, and with regard to last-look, time-stamping and the process of marking-up rates (adding spreads), among other areas of concern by the FCA.

Need for a solution

A recent report by BIS cited by Reuters said that there has been an increase in outbursts of volatility and flash events and that shrinking fx volumes could cause stability risks. This means that significant market reforms could help bolster the integrity of the markets while aiding its operational efficiency. Improving the market framework should help regulators have better oversight over firms’ execution practices while encouraging firms to adhere to such rules.

Retail traders in focus

For retail traders, the FX market could see an influx of new market entrants as the integrity of the market is bolstered thanks to the initiatives underway including a reduction in leverage which essential makes trading less risky when compared one a dollar for dollar basis in terms of the buying power in a margin account.

Although the Global FX Code is underway at the interbank level, over time this could reach down to online brokerages and other market participants and eventually affect retail traders where best-execution from a broker can be verified more easily.

Mid-level challenges

Other areas of concern pointed out by the FCA’s findings has to do with the practice of ‘last-look.’

Similar to asymmetrical slippage, last-look is a form of asymmetrical execution. When an order is received by a dealer for execution from a client, rather than executing it immediately at the rate that had been advertised or that is currently available, the dealer gets to decide whether the rate has since changed unfavourably – and instead cancel or re-quote the order.

Another alarming practice that has plagued traders in the FX industry for years that is only now coming to the spotlight by regulators is known as “stop-hunting”, or when a firm arbitrarily widens its bid or ask price to trigger client’s stop-loss orders.

Financial Commission welcomes the work underway via the Global FX Code and supports this voluntary effort, and calls upon brokers to join as members where they can demonstrate their commitment to self-regulatory compliance while meeting the guidelines that our members uphold to best serve clients.

Recently, the Financial Commission increasingly receives members’ inquiries asking to explain the key provisions and regulation specific in Belarus. High interest in this jurisdiction is justified and can be explained at least by the following:

Incomplete, incomprehensible and “expensive” regulation in Russia as well as absence of feedback from regulator regarding its prospects

On the contrary, favorable and comprehensible, based on European standards, Belarus regulation has a great chance to make this jurisdiction forex haven for the entire CIS.

In this article we want to make a detailed analysis of Belarus forex regulation to make it clearer and answer all industry questions regarding this matter.

In accordance with Edict № 231, Belarus forex regulation came into force in March 2016, since then, six companies and one of the national banks have already been included in the register of forex companies by the National Bank of the Republic of Belarus.

In order to provide services on retail Forex market in Belarus, first of all, it is necessary to obtain license issued by the National Bank of the Republic of Belarus to be included in the register of forex companies (simpler and “softer” analog of licensing), secondly, to undergo an assessment of software used in the National forex center and deposit a quarantee payment to the compensation Fund in amount of 55 000 US dollars (note: the payment will be returned in case of voluntary exit from the market without any uncovered obligations towards clients) and, thirdly, to become a member of the local Association of Financial Market Development – “ARFIN”.

Obtaining of license from the National Bank of the Republic of Belarus requires incorporation of local legal entity as well as preparation of all necessary documentation and going through certain legal procedures.

Basic requirements

|

Financial requirements |

||

|

Min. capital |

~$103,000 |

Funds must be allocated on the company’s account in one of the local banks |

|

Compensation fund payment |

$55,000 – guarantee fee +calendar fees in amount of 5% of the amount of total liabilities towards clients. Important! When the total amount of the company’s clients funds is reducing the calendar fees are paid back to the company. |

Funds are transferred to the National forex center and allocated on deposit in a local bank. |

|

Risk management and risk capital |

Yes |

Regulation has fairly strict risk management requirements which implies that the maximum size of own, not overlapped total position for each instrument may not exceed the amount of equity capital of the dealer. In fact, if the dealer does not have large equity capital, then, almost all clients positions should be hedged on an external counterparty. At the same time, regulation is quite flexible in choosing of counterparties and permits transactions with foreign companies. |

|

Trading conditions |

||

|

Max. leverage |

|

Professional client

Qualified client – legal entity or individual that:

Client – usual client who has minor trading experience or does not have any experience at all. *Base unit amounts to 21 Belarussian ruble or 10.83 USD |

|

Instruments |

FX and CFD |

|

|

Trading accounts in different currencies |

Yes |

|

|

PAMM accounts |

No |

The regulation does not have any specific requirements for asset managers, however, forex dealers can not represent independent managers on their websites and must not participate in negotiations between investors and managers. |

|

Copy trading |

Yes |

No additional requirements for dealers |

|

Market making |

Yes |

Accepted risks must correspond with company’s equity capital, if the established normative is exceeded, a mandatory withdrawal of positions on the counterparty must be carried out (see requirements for risk management) |

|

STP |

Yes |

Withdrawal on foreign brokers is possible |

|

Clients’ and own funds. Choise of counterparties |

||

|

Segregation of client’s funds |

No |

|

|

Allocation of client’s funds on foreign banks and financial companies accounts |

Yes |

50% of clients’ funds must be allocated on local bank account |

|

Using of client’s funds for hedging transactions abroad |

Yes |

Not more than 50% of clients’ funds may be allocated on counterparties’ foreign accounts for hedging and direct withdrawal of orders |

|

Allocation of own funds abroad |

Yes |

All company’s funds for hedging transactions abroad |

|

Requirements for foreign counterparties |

Yes |

Foreign counterparty should be an American, Japanese or Russian company with profile license (permission), as well as company with a license (permission) obtained in the European country applying provisions of MIFID. In addition, the counterparty may be a company from another jurisdiction, which is not offshore, if the performance of its obligations towards the forex company is guaranteed by the bank or other entity which financial viability is confirmed by the auditor’s report. Forex company may hedge transactions, in amount not exceeding 5 percent of the amount of client funds, in any foreign company which equity capital amounts to at least 5 million euros, as well as in parent company in any amount, but at its own expense. |

|

Sales and Marketing |

||

|

Forex services advertising requirements |

Yes |

Prohibition of guaranteed income promises, mandatory risks warning, prohibition on useage of information that is not evidenced documentary, etc. |

|

Sales ethics control |

No |

Indirectly (see advertising requirements) |

|

Opening of own offices |

Yes |

No specific requirements for office operating activity |

|

Introducing brokers |

Yes |

No specific requirements for introducing brokers |

|

Personnel professional requirements |

||

|

Director |

Yes |

Higher legal or economic education, no criminal record (unserved), absence of facts of initiation of criminal proceedings, as well as dismissal due to loss of confidence |

|

Internal Control Officer |

Yes |

Higher legal or economic education, no criminal record (unserved), absence of facts of initiation of criminal proceedings, as well as dismissal due to loss of confidence |

|

Dealer |

No |

|

|

Sales |

No |

|

|

Taxes and other fees |

||

|

Annual fee |

No |

|

|

Reporting to the depositary (the National forex center) |

Yes |

~$ 1,230 monthly. |

|

Company income tax |

Yes |

Reduced rate in amount of 9% until 2019, afterwards 18%. |

|

Function of a tax agent |

No |

The Company does not levy taxes from customers. |

|

Clients income tax |

No |

No income tax on forex trading until 2019. Afterwards 13%. |

Summing up all the analysis of forex regulation in Belarus, it can be said that:

Firstly, it is logical and clear to any international forex dealer

Secondly, it takes into account the interests of all parties (business, clients and state)

And, thirdly, has foundation that allows to carry out further improvements and changes.

For instance, at first glance it may seem that the requirement of allocation of 50% of client funds in Belarus looks tough enough as it deprives the dealer’s ability to use all client funds for hedging client positions on external counterparty. This point may seem especially painful for dealers working exclusively on STP model. However, in case of obligatory segregation of client funds such as, for example, in Russia, the client funds can not be used at all. Consequently, the dealer will have to do it either at his own expense or by obtaining a credit line from counterparties what is almost impossible if the forex license is not recognized by the state where the dealer’s counterparty registered.

In this case, Belarus regulation offers a compromise, which, on the one hand, gives the dealers the opportunity to use part of client funds for hedging transactions and, at the same time, prescribes to allocate half of client funds “at home”, thereby, significantly reducing risks of foreign counterparties which are supervised by authorities of other states.

July 28th, 2016, Hong Kong & New York: Financial Commission is pleased to announce the launch of Informational Newsletters that will assist traders in understanding trends and challenges related to foreign exchange disputes.

As a result of the growing number of companies within our organization, and as the underlying number of traders protected directly by the Financial Commission continues to rise, the newsletters will provide traders unique insight about brokerage complaints – to help traders be better-informed when considering where to trade.

The Informational Newsletters will be posted on a new section on FinancialCommission.org and will highlight forex industry issues and trends identified by the Commission during the examination of claims – including any fraudulent activity of unscrupulous market participants, in addition to other industry trends that will be shared in the updates.

External dispute resolution trends

By informing traders of challenges that exist within the industry, and helping inform the public on how complaints are handled via an External Dispute Resolution (EDR) process, Financial Commission continues to strive towards its goal to educate clients.

In addition, Financial Commission will be sharing complaint data received about non-member firms, highlighting the interest that traders have in attempting to resolve complaints via a 3rd party EDR – even when their broker is not currently a member.

The timing of this launch follows shortly after the recent Global Code of Conduct issued by the Bank for International Settlements (BIS) which aims to provide a basis for best practices in global FX markets.

Binary Options Complaints

Among the Members of the Financial Commission there are more and more companies offering binary options trading and an increasing amount of claims are connected with these products. It is obvious that Binary Options trading is becoming increasingly popular and attracts many inexperienced traders, yet the escalating number of complaints is intelligible.

Violation of payment processing regulations

Financial Commission has also observed a slight increase in the amount of complaints related to customers payment processing requests that exceeded the regulations time-limits. Almost every complaint was connected with a refund directly to a client’s bankcard. This withdrawal method has become increasingly popular in recent years, however, sometimes such payments are processed longer than bank transfer since they depend on a chain of intermediaries. All such complaints were upheld by member firms within 1-3 days, reflecting benefits from the Commission’s members.

Nonpayment of funds.

An increase in complaints from traders regarding nonpayment of funds by brokerage companies that are nonmembers of the Financial Commission was also observed. Unfortunately, these traders are not under the direct protection of Financial Commission, and its resources are limited in this connection, yet it is important for the public to be aware of such claims.

We once again urge clients to work with companies that are members of our organization, as well as take advantage of our advice on selecting companies that we cited earlier, in order to have the related potential benefits of Financial Commission membership.

Fraudulent activity of unscrupulous brokers and asset managers in the field of asset management.

We also observed an alarming trend worsen, as numerous complaints were received of unfair brokerage firms operating in the field of investment and asset management over the last six months.

In the modern world of investment consulting, services such as wealth and portfolio management as well as trading and investment advisory services are very common. However, distinguishing between legitimate professional management firms and from among the many non-professional deceitful entities – especially in markets where such services are not regulated, remains a challenge for both investors and traders.

First of all, firms that guarantee clients extraordinary profits without any risks should be the first red flag to look for when evaluating an opportunity.

For example, a client may be offered to invest and use instructions (trading signals) of “professional” analyst who in most cases has nothing to do with the broker itself. As a result, under the mentor guidance the client opens several large transactions which can instantly zero out the trading account. In this case mentor offers to replenish your account in order to recover the loss and the same story happens again after a subsequent deposit is made.

Avoid non-market losses that result from scams by avoiding their initial bait:

Financial Commission has prepared some recommendations in this regard:

1. Before you open a trading account, check whether the broker is a member of the Financial Commission.

2. Examine clients comments through the internet about brokers (forums, ratings, media) yet keep in mind not all comments reflect fully factual statements as some feedback reflects clients perceptions or wishes yet reviews can provide clients with a wider view.

3. Examine the contract and client agreement when opening the account, and read all the fine print to understand the legal aspects of your relationship with each broker.

4. In case of dealing with an asset manager, do not forget to conclude an additional agreement (that provides trading authorization) that contains the trading strategy, specifies the maximum risks and responsibilities of the parties, and provide it to the broker and/or make sure they permit such activity. Beforehand, be sure to become familiar with the fund manager and its trading operations and history (track-record).

5. Always remember that active trading is a high risk activity and each individual’s personal suitability should be taken into account in terms of whether such risk is suitable, before deciding to invest. We strongly recommend that traders constantly improve their knowledge in this area in order to make the right decisions both in trading and choice of partners.

List of nonmember companies against which complaints have been received.

|

Company |

Complaint description |

|

Fort Financial Services |

Profit annulment |

|

GAINSY |

Trading advising and forex investment proposals, falsification of known analysts names |

|

MXTrade |

Nonpayment of funds |

|

MyBoption |

Nonpayment of funds |

|

Pegase Capital Ltd |

Nonpayment of funds |

|

SunbirdFX |

Nonpayment of funds |

|

PLUS500 |

Nonpayment of funds |

RFED – Retail Foreign Exchange Dealer

CFTC

In 1974, the US Congress established the Commodity Futures Trading Commission (CFTC) – the federal regulatory agency with jurisdiction over futures trading.

The same law authorized the creation of a “registered futures association,” thus opening the possibility for the creation of self-regulatory organizations on the national level. That is how NFA was established in 1982, after it won the position while competing with another trade association called the Futures Industry Association (FIA) which was not selected.

In 2000 and 2008, Congress passed a law for certain types of companies requiring them to register with the CFTC and to become members of the NFA.

In 2010, Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act, which gave the CFTC rulemaking authority and oversight over swaps, swap dealers and major swap participants. Subsequently, the CFTC passed regulations requiring swap dealers and major swap participants to register with the CFTC and become Members of NFA.

NFA

The National Futures Association is a self-regulatory organization for the US derivatives industry including exchange-traded futures, OTC foreign exchange market (forex) and swaps.

NFA develops and implements policies and services to ensure the security and integrity of the market and investors protection.

Membership with NFA is mandatory for all companies operating on this market. Currently, NFA has about 4,100 member companies and 57,000 registered specialists.

NFA is a non-commercial, independent, self-regulatory organization which is entirely financed by membership fees.

1.Basic requirements for RFED

|

Type |

Requirement |

Details |

| Minimum equity capital |

$20,000,000 |

Level of early warning – 150%. I.e the dealer must maintain a minimum level of equity capital in the amount of $ 30m. Important: Being below $ 30m does not lead to revocation of the license, but the broker must notify the NFA each time the level of private capitalization falls below this rate. |

| Risk capital |

6% Major Currencies, 20% Exotics |

Risk capital is calculated separately on the basis of open currency positions of the dealer, which is kept on the firm’s own book (not overlapped on the counterparty positions). The sum of risk capital is an integral part of the formula for calculating a dealer’s own net capital. (Example: the sum of all assets – liabilities towards clients – risk capital – expenditures = net capital) |

| Membership fees |

$125,000 |

Paid annually |

| FX trading offering |

Individuals and legal entities |

________ |

| STP of FX Trades |

Yes |

Approved counterparties only:

|

| Futures |

Yes |

On-exchange traded contracts only. Additional capital requirements and segregation of funds will apply. |

| Options |

Yes |

Only stock options. Additional requirements to capitalization and obligatory segregation of funds. |

| FX leverage |

50:1 |

Calculated in a form of margin in US dollars. Therefore, the minimum margin required is 2%. |

| Futures margins | Please see marketplace specs. | |

| CPA Audit |

Every 12 months |

Audit of the financial statements prepared by a certified auditor (Certified Public Accountant audit). |

| NFA Audit |

Every 12 months |

Held in the company’s office by the NFA staff. |

| AML Training |

Every 12 months |

Held by accredited compliance professionals/certified auditor. |

| Ethics Training |

Every 36 months |

Held by accredited compliance professionals/certified auditor. |

| FinCen | Twice a month | Examination of the client base for any presence of individuals, firms requested by FinCen |

| 4G CFTC |

Upon request |

Examination of the client base for any presence of individuals, firms requested by CFTC |

2. Key responsibilities of the member:

3.Retail Foreign Exchange Dealer report requirements

|

Report description |