Automation tools for conducting trading on financial markets have existed for many years and have become quite popular with retail investors around the world. At first glance, such tools offer investors an advantage in finding price movements or patterns to earn a profit, but the use of such trading tools often comes with increased risks for the investor.

Such 3rd party automated trading tools are often referred to as robots, advisors, algorithms and the like. Popular trading platforms, such as MetaTrader have entire communities of traders and programmers who build so-called Expert Advisors – software that runs on the trading platform and conducts automated price analysis and trading.

Other broker platforms may have similar software that works on top of the existing platform infrastructure to help investors automate their trading strategies and market analysis.

Both novice and experienced traders need to keep in mind that using such trading tools can present additional risks for investors apart from possible losses incurred while trading. We cover some of these risks below.

Traders should carefully consider the methodology used by trading tools that are offered by brokers or 3rd parties to make sure they align with the investor’s trading goals, risk appetite and frequency of trading. For example, you should carefully study how the trading tool you want to use analyzes market data, finds trade scenarios and how it executes orders on your behalf on the trading platform. The latter is especially important in order to understand when and how the trading tool will be conducting trades for the user in a live environment. It is important to understand these details in order to analyze the amount of risk a trader is willing to tolerate when using 3rd party trading tools. Furthermore, the trader is responsible for understanding any settings or set up instructions required for the trading tools prior to using them in a live market.

Traders must also understand that any profits or, more importantly, losses incurred on their account while using 3rd party trading tools are their sole responsibility. Most brokers will include clauses in the agreements governing retail client accounts absolving them of any legal responsibilities for trades or analysis conducted using such tools. Before beginning to use a 3rd party trading tool, carefully consider your risk appetite and the funds you are willing to lose, should the trading tool not work in your favour.

Investors must understand that the resolution of disputes involving losses incurred from the use of automated trading tools often rests on the legally binding agreements between traders and their brokers. As mentioned above, such agreements almost always indicate that any trading results achieved using such tools are the responsibility of the trader.

Furthermore, according to the Financial Commission’s Rules & Guidelines, such disputes may be rejected by the organization, in cases where losses incurred by the trader were the result of using tools provided by 3rd party companies or trader communities and not directly by a broker member of the Financial Commission.

Given all these factors, traders must carefully consider if any 3rd party trading tools or software align with their trading strategy given the risks described above and the low probability of achieving success in any type of dispute that may arise from such automated trading.

Binary options are popular among beginner traders because they are very easy to understand. A binary option allows the trader to bet on whether the price of an asset will be above or below a certain target price (usually the current market price) at a future time. If a trader expects the price of an asset to increase, then they would buy a binary call option, which would result in a gain if the price of the asset rises above the target price. On the other hand, if the trader expects the price of the asset to drop, then they would buy a binary put option, which pays off if the price of the asset falls below the target price. The payout from a binary option is either a fixed amount in case the prediction by the trader is correct or nothing at all if the prediction is wrong. As such, these options are also referred to as cash-or-nothing options.

Asymmetric Payout of Binary Options

The reason why binary options are popular is because the payout typically ranges between 70% to 90% over a range of few minutes or hours, which makes them very enticing for a trader who wants to earn quick profits. However, binary options have a negative expected return because the payout is asymmetric. This asymmetry puts the trader at a disadvantage.

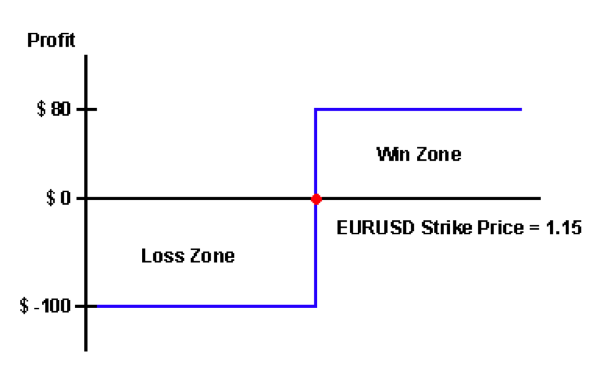

To illustrate this point, consider a trader who expects the EURUSD exchange rate to rise over the next hour. The trader decides to buy a binary call option for a cost of $100 and is guaranteed an 80% payout if their prediction is correct regarding the EURUSD rate, but loses everything if the prediction is wrong. If the target (strike) EURUSD price of the binary call option is 1.15 then the payout from the option for different ending price scenarios can be illustrated as per the chart below.

If we assume that the price of the EURUSD exchange rate has an equal probability of rising or falling, then the expected return can be calculated as follows:

Win = $100 x 80% = $80

Lose = -$100 * 100% = -$100

Expected Return = (Win x 50%) + (Lose x 50%) = -$10

In other words, a trader is expected to lose an average of $10 on each bet that is made.

For this game to be fair, the outcome of a win scenario should be equal to the outcome of a lose scenario, which means that a trader needs to be able to win at least 56% of the time to make the expected outcome equal to zero (i.e. $80 x 56% -$100 x 44% = 0).

While bonuses and incentives offered by brokers have become a common practice, we bring your attention to the fact that not all bonus programs are created equal. Trading bonuses can be difficult to understand for a new trader or even experienced trader and we advise customers to review any bonus program or promotion before entering into one.

Each bonus program offered by a particular broker should have terms and conditions that clearly indicate the way the bonus or incentive structure will work. Given our industry experience, below we present some important things to look for when choosing a bonus program from a broker.

Review the Terms and Conditions

The most important thing that a trader must do when deciding to participate in a bonus program is to evaluate the terms and conditions of the offer. Only then can a trader make an informed decision on whether the bonus structure and amount is suitable for him.

The terms of the offer should present to the trader the scenarios in which a bonus will be granted and in what way the bonus will be given to the customer. This may include a cash deposit into the customers trading account, a reduced spread to trade on or a physical gift that can be mailed to the customer.

Keep in mind that the scenario should give a clear example of how the bonus can be achieved. Make sure to check the start and end date of a bonus promotion to make sure that you can participate or complete any trade requirements in the allotted time. Likewise, if the promotion includes a trading requirement, you should evaluate your costs of achieving that trade requirement with your trading goals. It may turn out that your trading costs, including spread paid ultimately is higher than the bonus amount you earned.

Amount of bonus offered

We often see brokers offering very large bonuses to customers either as a cash value or as a percentage of their deposit. Often times, the bonus is structured around the customer’s first time deposit with the broker. In such cases, we advise clients to evaluate the terms and conditions before making a decision to enter the program.

Often times, high bonus amounts are not eligible for withdrawal by the customer. In such cases, you can receive the bonus on your account, but you can only use these funds for trading and cannot return them to your bank or card account. Again, the terms and conditions should always give you a description of how the bonus can be used.

In certain instances, high bonus amounts, especially those that are up to 100% of a customer’s deposit will have restrictions that do not permit the customer to withdraw any funds from their account until a certain amount of trading volume is conducted. In such cases, the trading volume requirement is significantly high. Traders using such bonus programs often find that they either do not have enough funds (including the bonus) to complete the trading requirement or incur losses during trading towards fulfilling the requirement and are forced to deposit new funds into their account. These types of aggressive bonus offers are likely to be detrimental to the customer, rather than a benefit.

Also keep in mind that a large bonus deposited to your account will likely increase the amount of funds you have to trade, especially if you are trading with leverage. In this case, while you have more funds to trade with and can open bigger market positions, you must always be aware of the risks of leverage trading. If you open a big position, you must maintain a margin requirement on this position. It is likely that a market move against your position will cause your position to be liquidated quicker than had you have a smaller position and employed proper risk/reward strategy.

A similar, but more risky bonus promotion can contain an increase in “buying power”. These types of offers will allow the bonus amount to be deposited into your account only to increase the maximum position size that you can open by increasing your account balance, but when calculating the margin requirement for a position, this bonus amount will not be counted. As such, you can open a larger position, but you cannot withstand a larger loss in your account before a margin call. Trading with this type of bonus significantly increases the risk of losses for customers.

Calculating a bonus

The broker’s bonus promotion should also provide you with a simple way to calculate what your bonus amount is or will be in the future. More often these days bonuses are offered as a percentage of your initial deposit. In such cases, you should keep in mind that the bonus calculation will only include new funds that you have deposited and not those that you may have transferred from an existing trading account at your broker or an account at another broker. Likewise, some bonus programs will not count any subsequent deposit you have made towards a bonus calculation.

Some bonus programs also have a tiered structure, meaning that the amount you will receive in bonus increases as you deposit more funds or conduct more trades. We advise you to be careful when evaluating such programs and keep in mind your financial and trading strategy. You should be aware of how much money you can afford to invest in trading and how many trades you are willing to conduct based on your risk profile. As we mentioned above, sometimes the costs associated with completing the required number of trades is higher than the actual bonus amount you receive.

Where to get help

We advise you to carefully evaluate a bonus program based on your trading goals. If you have any questions about a bonus program, you should contact your broker directly before making a decision to enter into the program.

You can also contact the Financial Commission with questions as we offer assistance to traders free of charge.

|

How bitcoin evolved from post-crisis fintech innovation

The trillions of wealth wiped from the global financial system due to the Great Financial Crisis (GFC) triggered by a cascading failure linked together by systemic risk caused by derivatives reached $22 trillion, according to a report by the U.S. government accountability office.

In the last ten years since the GFC, a multitude of alternative asset classes emerged across the globe, with digital assets representing the newest breed with unique genetic characteristics and traits not seen in prior generations of technology.

Bitcoin is an example of the largest cryptocurrency to date, in terms of market capitalization and network size, and below are some of the drivers that helped propel this newly maturing cryptocurrency and the broader crypto-industry emerging since then.

Low rates shifted interest into fintech-powered alternatives finance

The low-interest rate environment that persisted as a result of the GFC globally has caused many institutional investors to seek higher yields in alternative markets.

This influx of [smart money] capital into alternative investments and alternative asset classes (i.e., non-bank products) helped fuel the emergence of new financial products thanks to innovative financial technology (FinTech).

The Era of P2P Crowdfunding and Social Networks

As investors sought higher yields in alternative markets, Fintech companies applied innovative experimentation with new financial products across industries to capture existing and expected demand for alternative financial products.

Venture Capital (VC) and private equity (PE) investments in FinTech companies have helped accelerate these trends across various industries as global markets for alternative finance continued to mature. The emergence of peer-to-peer (P2P) technology has coincided with trends in payments apps, social networks, as well as social trading, and crowdfunding.

The emergence of a new Crypto taxonomy of financial products: digital assets

During the midst of the GFC in 2008, a document was published titled: “Bitcoin: A Peer-to-Peer Electronic Cash System,” authored by the pseudonym “Satoshi Nakamoto.”

This white paper for Bitcoin described the use of cryptographic proof – to replace the need for any trust between peers in a network by using cryptography as a validation mechanism thus relinquishing the need for any trusted third party or central authority.

Bitcoin

Bitcoin is a digital currency that runs on a distributed peer-2-peer (P2P) decentralized network on the global internet supported by its community of users. Users transact bitcoin between two unique public addresses, one belonging to the sender and the other to the receiver, and a small transaction fee is paid by the sender to miners within the network who help process the transaction (more on that below).

Being decentralized and public helps bitcoin to maintain its distributed network which consists of copies of its ledger hosted by users in what is called a node. The current size of the bitcoin ledger (bitcoin) is currently nearly 145 gigabytes and growing each day, and this represents the amount of hard drive storage needed for anyone to run a full node.

Bitcoin nodes

Hosting a full node, which can be done by nearly anyone, helps to support and run the bitcoin network. By running a full or partial node, users contribute to the collective network of nodes which act as a checkpoint for the entire ecosystem as each node contains the entire ledger with an immutable history of transactions that have already been deemed irreversible (more on how transactions are processed and mining below).

Bitcoin mining

The potential supply of bitcoin is limited due to the code used in the protocol that bitcoin must follow without exception (not including forks, more on that later). There can never be more than 21 million bitcoins created, and there are already nearly 17 million in existence.

Bitcoins are created based on a multi-step process where user-operated/owned computers are dedicated to trying to guess a nonce, which is a sufficiently large arbitrary number that is generated randomly and with increasing difficulty to find. The increasing mining difficulty together with a limited potential supply creates a narrow channel to keep inflation contained, compared to traditional fiat currencies such as US Dollars or Euros (where inflation rates are attempted to be controlled by a central bank).

Mining Difficulty

The difficulty rate to be the first to find the next nonce – to be rewarded the bitcoin produced in the next block – is so high currently that entire factories of interconnected servers running specialized computer processing (mining) hardware are dedicated to achieving the required hashing rates to make mining worthwhile.

Network incentives: Mining and Network Fees

Each time a nonce is correctly guessed, a new block is created, and the correct nonce number becomes hashed or connected to the prior block, acting as a liner chain between the prior and current block.

Miner Rewards

The miner or pool of miners that guessed the correct nonce is awarded the bitcoin amount contained in the newly minted block, which is currently 12.5 bitcoin per block.

Users who participated in mining the block also compete to add recent bitcoin transactions made between users transacting bitcoin in the network into the newly mined block to verify them.

Miner Fees

Senders of bitcoin pay a network fee to miners and miners are incentivized to include these transactions in new blocks to earn the network fee paid by the sender of each bitcoin transaction.

This structure supports the flow of capital within the bitcoin network while keeping miners interest vested in supporting the ongoing maintenance of the network which in turn supports more users within the network which then again returns value to miners in the form of transaction fees.

Bitcoin cyclical price growth

The cyclical process that bitcoin’s network structure follows is similar to economic cycles. Bitcoin can be thought of as an economy and was literally in the top 40 globally when comparing its M1 money supply, as of November 2nd, 2017 when it’s market cap surpassed $110 billion dollars after the price of 1 bitcoin reached $7200.

Many consider bitcoin to be in a price bubble, yet when examined over its historical price action, bitcoin has already had numerous bubbles where its price inflated and deflated over nearly the last nine years.

Passive investing in cryptocurrencies

Despite rebounding higher in its last wave (current bubble) if the underlying drivers that are causing it to become accepted continue, some analysts believe it could reach $1million per bitcoin in just a few years, while others believe it will fail or be superseded by next-generation crypto networks with more advanced survival traits.

These challenges make it very difficult for even the most passive investors as maintaining a diversified portfolio in cryptocurrency markets may require very active rebalancing as the rankings of digital assets are constantly changing (when comparing the top 50 cryptocurrencies for example over just the last few months).

Social crypto networks

Just as FaceBook – which is not currently a crypto network – needs to maintain users to monetize their attention as the currency in its social network by charging marketing firms to display ads to users, the size of a crypto network is a major driver of its price valuation. Without any underlying users, the network wouldn’t be of value to anyone.

However, with FaceBook the “currency” in its network is paid to FaceBook from marketers, and users are not able to participate in those benefits beyond the utility derived from using the Facebook platform. Public crypto networks that are inherently P2P may eliminate the need for a middleman, but maintaining the network size and growth rate is the key to its sustainability, utility and any resulting valuation.

P2P transfers without the need for a trusted 3rd party

While the need for trusted third parties has been replaced in crypto networks such as bitcoin, there are still inherent risks such as ensuring there are enough users to generate enough transactions to incentive enough miners to support the network and the price of the digital asset that helps fuel it.

Network cycles

Bitcoin is no exception, and just like any crypto network, there must be enough users in the bitcoin network to generate enough transactions, to support the demand (price) while incentivizing miners to process transactions and supply mining newly minted bitcoins. Bitcoin’s network follows a cyclical process and is comparable to other natural economic cycles within global marketplaces across industries where commerce takes place.

Private-key/Public addresses

All bitcoin transactions are made between public bitcoin addresses where the respective holders of each bitcoin address own a unique private key connected to the respective public address (except for coinbase transactions which are created by miners when bitcoin is awarded from mining a block).

Public nature of bitcoin

While purchasing or mining bitcoin may come under the control of law, anyone is free to do the math to generate a nearly-unlimited number of bitcoin addresses for free using the open-source public code, and this can even be done off-line, ideally on an air-gapped computer to reduce the likelihood of a screen-recording or keylogging malware.

Therefore, safeguarding private keys is another challenge on its own and is where significant risk remains as lost funds – whether due to hackers obtaining private keys or users forgetting or misplacing their private keys – means that lost bitcoin is unrecoverable.

Private key = digital asset

Each private key is akin to a secret password that is fixed and cannot be changed, and the address owner must safeguard this private key as it is the sole backup to control their digital asset (unless the key is safeguarded by a 3rd party exchange).

Anyone who obtains access to your master private key, known as a recovery passphrase or master seed, can access your digital asset. Therefore, safeguarding private keys becomes of paramount importance to protect bitcoin from theft or accidental loss due to forgotten or misplaced keys as they are unrecoverable.

Elliptic Curve Cryptography

Master Private Keys are generated using an open-source computer code that uses complex math to generate very large random numbers that are subsequently used in a multi-step computational process (involving more random numbers) with each step independent of each other.

This process which incorporates Elliptic Curve Cryptography (ECC) helps ensure a level of security that complies with some of the highest standards of encryption making it nearly impossible or improbable to guess/hack/crack the private key.

Crypto assets such as bitcoin follow some of the highest standards of encryption currently available, combining elliptic curve cryptography (ECC) to generate public/private key pairs, and the Secure Hash Algorithm (SHA) for mining blocks (more on mining below).

Securing digital assets

SHA-2 was developed by the U.S. National Security Agency (NSA) and the SHA family including SHA-3 is widely considered one of the strongest forms of encryption (sufficient even for military and Government top secrets).

Although the SHA2 family of algorithms was patented by the NSA, they were later released under a royalty-free license on June 20th, 2007 and are today widely used on the internet.

Today, SHA-related encryption can be found in many common computer applications and services across the internet as it is used for authentication (encrypting/decrypting) access to secure online services from both commercial enterprises and in free open-source software code/applications.

Mnemonic Passphrases For Recovery and Control of Digital Assets

SHA2 is considered secure because the resulting private keys that are generated (in which case with digital assets like bitcoin follow methods like BIP32 or BIP44 and then are converted into an easy to remember passphrase of 12-24 words via methods like BIP39) have between 256-512 bits of entropy. Entropy is a rating of the inherent protection passwords have against collision attacks (i.e., accidental guess or hackers trying to crack via brute force).

However, the risk for users to safeguard those keys is an entire different responsibility and is where the significant risk lies because hackers could obtain those keys and access your digital assets as described earlier.