今日,金融委员会正式宣布Strifor为其最新的批准会员。作为新晋在线经纪商,Strifor加入这一自我监管论坛的行列,这进一步突显了外汇行业参与者对独立外部争议解决(EDR)服务的日益增长的关注和需求。

The Financial Commission today announces Orfinex as its newest approved Member. The company becomes the latest online brokerage to join the ranks of the self-regulatory forum, highlighting the increased interest and demand for independent external dispute resolution (EDR) services among FX industry participants.

Orfinex status as an Approved Broker Members of the Financial Commission took effect on April 17th, 2024, following the approval of its membership application by the Financial Commission, thus allowing the company and its customers access to a wide range of services and membership benefits including, but not limited to, protection for up to €20,000 per the submitted complaint, backed by the Financial Commission’s Compensation Fund.

The Financial Commission provides brokerages and their customers with an unbiased 3rd party mediation platform that helps resolve complaints in instances when parties are unable to directly come to an agreement over disputes.

For approved members and their clients participating in CFDs, foreign exchange (forex), and cryptocurrency markets, the Financial Commission helps facilitate a simpler, swifter resolution process than through typical regulatory channels such as arbitration or local court systems.

Orfinex joins a diverse range of brokerages and independent service providers (ISPs) that utilize the services of the Financial Commission as part of their commitment to their clients while upholding membership requirements.

About Orfinex

Orfinex is a premier trading platform regulated by the Financial Sector Conduct Authority (FSCA) under FSP No. 53184, providing comprehensive retail and institutional trading solutions. Founded in Melbourne, Australia, in 2015, Orfinex has expanded its operations across multiple countries, with its headquarters in the heart of Australia’s financial hub. As a multi-regulated entity, Orfinex boasts a robust clientele base of both retail and numerous institutional clients, delivering superior service and maintaining high standards of compliance and security. Orfinex Prime is renowned for its exceptional client support, advanced trading infrastructure, and commitment to providing a seamless trading experience globally.

For more information about Orfinex, please contact them directly

About Financial Commission

Financial Commission is an independent external dispute resolution (EDR) forum for consumers/traders who are unable to resolve disputes directly with their financial services providers that are members of the Financial Commission. The Financial Commission initially set out to provide a new approach for traders and brokers alike to resolve any issues that arise in the course of trading electronic markets such as Foreign Exchange, and then expanded into CFDs and related derivatives, in addition to certifying technology platforms used for trading.

For more information please contact us at [email protected].

今日,金融委员会正式宣布Strifor为其最新的批准会员。作为新晋在线经纪商,Strifor加入这一自我监管论坛的行列,这进一步突显了外汇行业参与者对独立外部争议解决(EDR)服务的日益增长的关注和需求。

Strifor自2024年3月14日起正式成为金融委员会认可的经纪商会员,这一资格是在其会员申请获得金融委员会批准后生效。因此,Strifor及其客户能够享受到一系列广泛的服务和会员权益,其中包括但不限于:针对每起提交投诉提供最高达2万欧元的赔偿保护,此保障由金融委员会赔偿基金支持。

金融委员会为经纪商及其客户提供了一个公正中立的第三方调解平台,在双方无法就争议直接达成一致时,协助解决投诉问题。

对于参与差价合约(CFDs)、外汇及加密货币市场的已批准会员及其客户,金融委员会提供了一种相较于常规监管渠道如仲裁或地方法院系统更为简洁、高效的纠纷解决方案。

Strifor已加入到利用金融委员会服务的多元化经纪商和独立服务提供商(ISPs)行列,这是其对客户服务承诺的体现,并在遵守会员要求的同时,为客户提供更加可靠的服务保障。

关于Strifor Strifor是一家年轻但已树立良好信誉的经纪商,公司信条是“我们始终履行支付”,这意味着公司始终如一地履行自身义务。公司的使命是在金融市场中营造一种理性的交易思维文化。专注于经纪服务,Strifor提供多种资产的差价合约(CFD)交易,包括货币、加密货币、指数及贵金属,拥有超过250种交易选择。该经纪商主要采用MT5交易平台,被誉为最先进的现代交易平台之一。客户可以从四种类型的交易账户中选择,其中入门级账户无最低入金限制。此外,还提供最高1:500的杠杆进行保证金交易。

欲了解更多关于Strifor的信息,请直接联系该公司。

关于金融委员会 金融委员会是一个独立的外部争议解决(EDR)论坛,专为那些无法与身为金融委员会成员的金融服务提供商直接解决纠纷的消费者/交易者提供服务。金融委员会最初旨在为交易者和经纪商提供一种新的途径,以解决在交易诸如外汇等电子市场过程中产生的任何问题,并随后扩展到涵盖差价合约(CFDs)及相关衍生品领域,同时对用于交易的技术平台进行认证。

若需更多相关信息,请通过[email protected]联系我们。

今日,金融委员会正式宣布Fusion Markets为其最新的批准会员。作为新晋在线经纪商,Fusion Markets加入了这一自我监管论坛的行列,这进一步突显了外汇行业参与者对独立外部争议解决(EDR)服务日益增长的关注与需求。

Fusion Markets自2024年3月6日起正式成为金融委员会认可的经纪商会员,这一资格是在其会员申请获得金融委员会批准后生效。因此,Fusion Markets及其客户能够享受到一系列广泛的服务和会员权益,包括但不限于:针对每起提交投诉提供最高达€20,000的赔偿保护,此保障由金融委员会赔偿基金支持。

金融委员会为经纪商及其客户提供了一个公正中立的第三方调解平台,在双方无法就争议直接达成一致时协助解决投诉问题。

对于参与差价合约(CFDs)、外汇及加密货币市场的已批准会员及其客户,金融委员会提供了一种相较于常规监管渠道如仲裁或地方法院系统更为简洁、高效的纠纷解决方案。

Fusion Markets加入了一众利用金融委员会服务的多元化经纪商和独立服务提供商行列,这体现了他们对客户服务承诺的坚守以及满足会员要求的决心。

关于Fusion Markets是一家以低交易成本引领外汇与差价合约市场的企业,秉持着提供最佳交易环境和最低成本的核心使命。该平台服务于全球数万交易者,屡获殊荣,因其在大幅降低成本的同时提供优质服务而备受赞誉。Fusion Markets提供全天候支持、顶级交易平台以及一系列独特功能,证明了低成本并不意味着牺牲品质,高品质、低成本的交易可以面向所有用户开放。

欲了解更多关于Fusion Markets的信息,请直接联系该公司。

关于金融委员会 金融委员会是一个独立的外部争议解决(EDR)论坛,专为那些无法与身为金融委员会成员的金融服务提供商直接解决纠纷的消费者/交易者提供服务。金融委员会最初旨在为交易者和经纪商提供一种新的途径,以解决在交易诸如外汇等电子市场过程中产生的任何问题,并随后扩展到涵盖差价合约(CFDs)及相关衍生品领域,同时对用于交易的技术平台进行认证。

若需更多相关信息,请通过[email protected]联系我们。

今日,金融委员会宣布Ultima Markets为其最新获批的会员单位。Ultima Markets成为加入该自律论坛的最新线上经纪商,这一举动凸显了外汇行业参与者对独立外部争议解决(EDR)服务日益增长的关注和需求。

金融委员会于2024年3月4日正式批准Ultima Markets成为其认可的经纪商会员,该决定是在金融委员会对其会员申请审批通过后生效。由此,Ultima Markets及其客户将能够享受到一系列广泛的服务和会员权益,其中包括但不限于:每起提交投诉最高可获得由金融委员会赔偿基金支持的2万欧元保护。

金融委员会为经纪商及其客户提供了一个公正的第三方调解平台,在双方无法直接就争议达成一致意见时,协助解决投诉问题。

对于参与差价合约(CFDs)、外汇及加密货币市场的已批准会员及其客户,金融委员会提供了一种相较于常规监管渠道如仲裁或地方法院系统更为简洁、快速的纠纷解决方案。

Ultima Markets加入了一众利用金融委员会服务的多元化经纪商和独立服务提供商行列,此举体现了他们对客户服务承诺的坚守以及满足会员要求的决心。

作为领先的差价合约(CFD)交易经纪商,Ultima Markets提供超过250种金融工具的交易通道。我们以“终极交易门户”为口号,是一家快速成长、拥有全面许可且受到严格监管的经纪公司。我们的先进金融科技使用户能够交易外汇、股票、金属、能源、指数及加密货币等各类产品。目前,我们服务于全球172个国家和地区的客户,并拥有一支由各领域优秀人才组成的团队。

欲了解更多关于Ultima Markets的信息,请直接与他们取得联系。

关于金融委员会 金融委员会是一个独立的外部争议解决(EDR)论坛,专为那些无法与身为金融委员会成员的金融服务提供商直接解决纠纷的消费者/交易者提供服务。金融委员会最初旨在为交易者和经纪商提供一种新的途径,以解决在交易诸如外汇等电子市场过程中产生的任何问题,并随后扩展到涵盖差价合约(CFDs)及相关衍生品领域,同时对用于交易的技术平台进行认证。

如需更多相关信息,请通过[email protected]联系我们。

金融委员会,作为服务于金融服务业的领先外部争议解决(EDR)论坛,就其近期揭露的一起假冒代表骗局调查发布了更新。该骗局中,不法分子冒充金融委员会以欺诈交易者并进行敲诈勒索。

金融委员会在2023年12月15日的通知中已对这一假冒代表团伙向公众发出了警告。

随着对此事的进一步调查,金融委员会认为这些声称是本委员会工作人员的个人,正锁定那些最近成为非法经纪商受害者的交易者,这些受害者在诸如Umarkets、TPG Deals、Universe Financial Brokers、Kiexo、Izzi、Your Global Deal等公司因无正当理由而遭受资金损失或提款受限。这些假冒代表向受害者提供资金追回和拒付服务。

为了提供这样的服务,这些自称是金融委员会员工的人士向受害者收取费用,在某些情况下还通过伪造的法律服务公司,如Orbital Limited、Arbitrum Law Firm、AK Law、Guardians Recovery等,向受害者提供虚假的担保信函。

此外,这些假冒代表还模仿了合法且知名的在线数字资产钱包提供商的联系方式,包括Blockchain.com和Coinwallet,以此欺骗受害者支付其虚假服务的费用。

为了保护交易者,金融委员会再次强烈建议公众及外汇经纪商客户注意以下几点:

金融委员会将持续与公众合作,识别并剔除潜在的欺诈行为,并将采取积极措施确保与交易者的通信安全。我们鼓励所有交易者向我们报告任何声称代表金融委员会的个人或实体。

关于金融委员会

金融委员会是一个独立的外部争议解决(EDR)论坛,为那些无法直接与其成员金融服务提供商解决纠纷的消费者/交易者提供服务。金融委员会最初旨在为交易者和经纪商提供一种新的途径,以解决在外汇等电子市场交易过程中产生的任何问题,并随后扩展到涵盖差价合约(CFDs)及相关衍生品领域,以及对用于交易的技术平台进行认证。

The Financial Commission today announces that the membership status of Alpari and FXTM has ceased following a voluntary withdrawal.

Alpari and FXTM have been members of the Financial Commission up until 27 January 2024, when their membership was effectively withdrawn.

The Financial Commission notes that it will not be able to process any new complaints from Alpari or FXTM traders, following the withdrawal of membership from the Financial Commission as of 27 January 2024, and moving forward or until membership is approved again.

Furthermore, as non-members, Alpari and FXTM clients will not be eligible for reimbursement from the Financial Commission’s compensation fund. The compensation fund can only be used by clients of approved members and is subject to the ruling of our Dispute Resolution Committee. The compensation fund is designed to help protect members’ clients in exceptional cases and is funded by the Financial Commission from a portion of membership dues.

An updated list of current and prior members can be found on our website, including members who have either been expelled or withdrawn voluntarily.

The Financial Commission requires that member firms strictly adhere to membership rules to maintain good standing on an ongoing basis. To learn more about our membership requirements and certification process, contact us or visit https://financialcommission.org.

About The Financial Commission

The Financial Commission is an independent external dispute resolution (EDR) forum for consumers/traders who are unable to resolve disputes directly with their financial services providers who are members of the Financial Commission. The Financial Commission initially set out to provide a new approach for traders and brokers alike to resolve any issues that arise in the course of trading electronic markets such as Foreign Exchange, and then expanded into CFDs and related derivatives, in addition to certifying technology platforms used for trading.

For more information, please contact us at [email protected].

The Financial Commission, a leading external dispute resolution (EDR) forum catering to the financial services industry announces the appointment of Ms. Opal Yang Founder and CEO of New Direction Solution to its Dispute Resolution Committee (DRC).

Enhancing the DRC structure

Ms. Yang is the 36th member industry expert to join the Financial Commission’s DRC since its inception in 2013. The DRC consists of a diverse panel of industry professionals, who follow a non-biased protocol to process and resolve complaints from our members’ clients.

Financial Commission Chief Operating Officer, Nikolai Isayev commented on the appointment: “I am excited to welcome Opal to our dispute resolution committee. Given her tenacious pursuit of protecting traders’ interests throughout her career and expert knowledge of the trader and broker landscape in Asian markets, she will be a valuable asset to our DRC committee in helping us tailor our mediation service to a wider group of traders and brokers in one of the fastest-growing regions of the world.”

About Opal J.Y. Yang

Ms. Opal Yang is a distinguished professional in finance and marketing, currently serving as the Founder and CEO of New Direction Solution, headquartered in London. With an illustrious career spanning two decades, Ms. Yang has held key management roles in prominent banking, asset management, and brokerage firms across diverse Asian markets and the United Kingdom.

Distinguished by its expertise in the Chinese-speaking markets, New Direction Solution stands as a premier consultancy firm committed to bridging the gap between the Far East and Europe. The firm specializes in delivering comprehensive financial services with a focus on broker licensing, merger and acquisition, fintech start-up consultation, and project management. Beyond its core services, the firm also excels in dispute resolution and managing complaints and compensations when necessary.

With a global perspective and localized expertise, the firm is poised to navigate the complexities of international finance, contributing to the success of its clients in the Far East and Europe.

About The Financial Commission

The Financial Commission is an independent external dispute resolution (EDR) forum for consumers/traders who are unable to resolve disputes directly with their financial services providers who are members of the Financial Commission. The Financial Commission initially set out to provide a new approach for traders and brokers alike to resolve any issues that arise in the course of trading electronic markets such as Foreign Exchange, and then expanded into CFDs and related derivatives, in addition to certifying technology platforms used for trading.

For more information, please contact us at [email protected].

The Financial Commission today announces VT Markets as its newest approved Member. The company becomes the latest online brokerage to join the ranks of the self-regulatory forum, highlighting the increased interest and demand for independent external dispute resolution (EDR) services among FX industry participants.

VT Markets status as an Approved Broker Members of the Financial Commission took effect on January 30th, 2024, following the approval of its membership application by the Financial Commission, thus allowing the company and its customers access to a wide range of services and membership benefits including, but not limited to, protection for up to €20,000 per the submitted complaint, backed by the Financial Commission’s Compensation Fund.

The Financial Commission provides brokerages and their customers with an unbiased 3rd party mediation platform that helps resolve complaints in instances when parties are unable to directly come to an agreement over disputes.

For approved members and their clients participating in CFDs, foreign exchange (forex), and cryptocurrency markets, the Financial Commission helps facilitate a simpler, swifter resolution process than through typical regulatory channels such as arbitration or local court systems.

VT Markets joins a diverse range of brokerages and independent service providers (ISPs) that utilize the services of the Financial Commission as part of their commitment to their clients while upholding membership requirements.

About VT Markets

VT Markets, founded in 2015, is a global multi-asset CFD broker. The company’s mission is to build a next generation platform with superior trading environment for every trader across the globe. VT Markets is more than a platform, it is a place to capture market opportunities and achieve your own success. Join VT Markets and experience the difference today.

For more information about VT Markets, please contact them directly

About Financial Commission

Financial Commission is an independent external dispute resolution (EDR) forum for consumers/traders who are unable to resolve disputes directly with their financial services providers that are members of the Financial Commission. The Financial Commission initially set out to provide a new approach for traders and brokers alike to resolve any issues that arise in the course of trading electronic markets such as Foreign Exchange, and then expanded into CFDs and related derivatives, in addition to certifying technology platforms used for trading.

For more information please contact us at [email protected].

Concerned traders have notified the Financial Commission regarding the company PionexFX and its associated website.

Upon reviewing the submitted information from potential customers of this broker, the Financial Commission has determined that the indicated company and associated website may be used to scam and defraud traders and investors. As such, the Commission does not recommend doing business with this entity, either individuals purporting to represent this broker on social media or in private messages on popular messaging apps. Given this information, PionexFX will be placed on the Financial Commission’s Warning List.

Don’t miss the latest news and discussion on our Telegram channel. Subscribe today

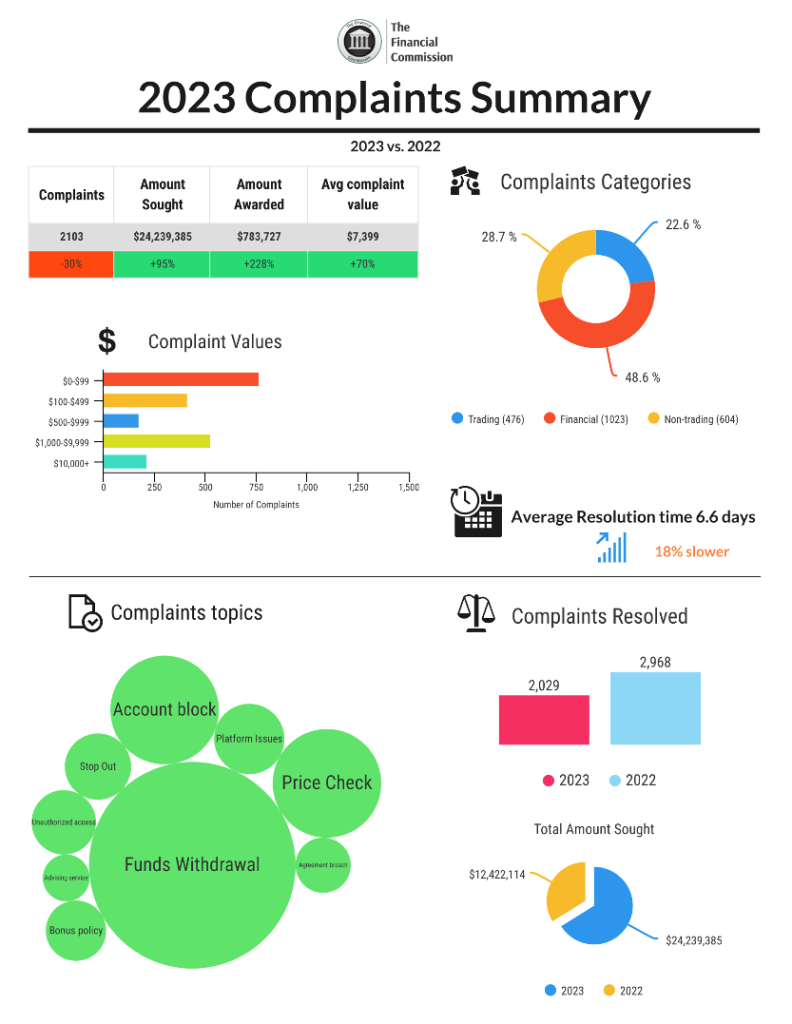

金融委员会今天宣布了其上年度运营结果,通过发布2023年投诉总结报告。论坛在多个关键指标上实现了显著增长,包括索赔总额、向交易者赔付金额以及全年投诉价值,并且由于会员公司提交投诉流程的优化改进,导致全年的总投诉量和解决数量都有所下降。

同时,论坛继续在关键地区引入新的经纪商成员,并在市场波动不稳与地缘政治不确定性持续扩大的一年中,致力于保护交易者免受在线骗局的影响。

2023年关键亮点与成就

其他2023年度关键指标

年度投诉总结报告下载链接

关键要点总结

结论

金融委员会在2023年继续优化针对交易者和经纪商成员的快速高效的争议解决服务。全球市场价格波动加剧及地缘政治不确定性增加刺激了在线交易的兴趣,使得2023年与交易相关的投诉份额有所上升。通过改进与经纪商成员之间的投诉提交流程,今年整体投诉量下降,其中非交易类投诉的比例较上年下降了65%,有助于交易者更快地通过经纪商解决纠纷。

组织进一步扩大了会员规模,特别是在亚洲地区增加了新成员。免费提供给交易者的争议解决服务在亚洲地区依然受到欢迎,该地区的新投诉占比达到46%。值得指出的是,纠纷调解论坛在中东地区的知名度提升,新投诉占比达24%,同时在拉丁美洲也取得进展,占2023年投诉的10%。来自非洲国家的投诉增长了16%,反映出零售交易在此区域日益流行。

2023年的大多数投诉与财务问题相关(占总数的49%),交易相关纠纷占比23%,非交易相关投诉占比29%。最常出现投诉主题包括资金提取(41%)、账户封锁(24%)、价格核对(11%)、平台问题(5%)和强制平仓订单(3%)。已解决的所有投诉中,32%被裁定“有利于经纪商”,12%“有利于客户”,而56%的投诉被认定超出组织管辖范围。交易者胜诉的比例比上一年提高了30%。

展望2024年,金融委员会预计全球范围内对交易和投资的需求将持续增长,尤其是年轻交易者群体,由于财政和地缘政治风险影响货币、商品(特别是黄金和股票)的价格走势,组织准备应对年内可能增加的来自交易者的投诉数量。

关于金融委员会

金融委员会是一个独立的外部争议解决(EDR)机构,专门为无法直接与其金融服务提供商(这些提供商是金融委员会成员)解决争议的消费者/交易者提供服务。起初,金融委员会旨在为交易者和经纪商提供一种新的方式来解决电子市场交易过程中产生的任何问题,如外汇交易,后来扩展到了差价合约(CFDs)及相关衍生品领域,并开始认证用于交易的技术平台。

如需更多信息,请通过[email protected]联系我们。

Concerned traders have notified the Financial Commission regarding the company CGMD Miner and its associated website.

Upon reviewing the submitted information from potential customers of this broker, the Financial Commission has determined that the indicated company and associated website may be used to scam and defraud traders and investors. As such, the Commission does not recommend doing business with this entity, either individuals purporting to represent this broker on social media or in private messages on popular messaging apps. Given this information, CGMD Miner will be placed on the Financial Commission’s Warning List.

Don’t miss the latest news and discussion on our Telegram channel. Subscribe today

Concerned traders have notified the Financial Commission regarding the company BluestarPros and its associated website.

Upon reviewing the submitted information from potential customers of this broker, the Financial Commission has determined that the indicated company and associated website may be used to scam and defraud traders and investors. As such, the Commission does not recommend doing business with this entity, either individuals purporting to represent this broker on social media or in private messages on popular messaging apps. Given this information, BluestarPros will be placed on the Financial Commission’s Warning List.

Don’t miss the latest news and discussion on our Telegram channel. Subscribe today

Concerned traders have notified the Financial Commission regarding the company us24trades and its associated website.

Upon reviewing the submitted information from potential customers of this broker, the Financial Commission has determined that the indicated company and associated website may be used to scam and defraud traders and investors. As such, the Commission does not recommend doing business with this entity, either individuals purporting to represent this broker on social media or in private messages on popular messaging apps. Given this information, us24trades will be placed on the Financial Commission’s Warning List.

Don’t miss the latest news and discussion on our Telegram channel. Subscribe today

Concerned traders have notified the Financial Commission regarding the company NFC-Wallet (NFC LIMITED) and its associated website.

Upon reviewing the submitted information from potential customers of this broker, the Financial Commission has determined that the indicated company and associated website may be used to scam and defraud traders and investors. As such, the Commission does not recommend doing business with this entity, either individuals purporting to represent this broker on social media or in private messages on popular messaging apps. Given this information, NFC-Wallet (NFC LIMITED) will be placed on the Financial Commission’s Warning List.

Don’t miss the latest news and discussion on our Telegram channel. Subscribe today