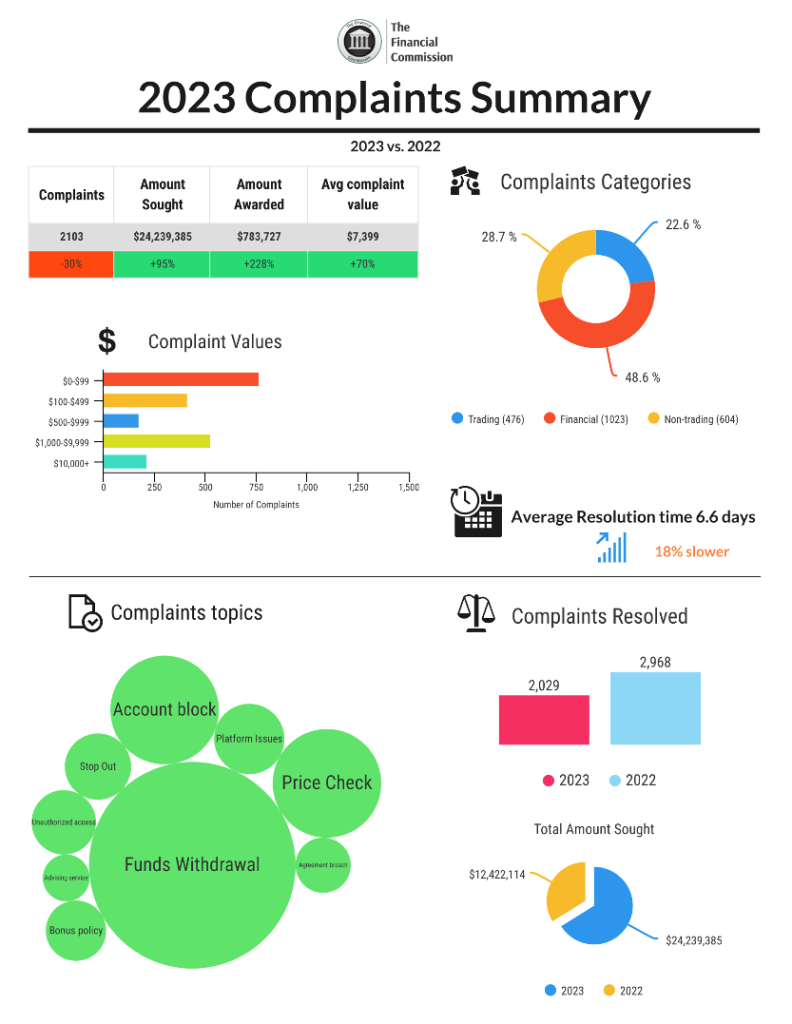

金融委员会今天宣布了其上年度运营结果,通过发布2023年投诉总结报告。论坛在多个关键指标上实现了显著增长,包括索赔总额、向交易者赔付金额以及全年投诉价值,并且由于会员公司提交投诉流程的优化改进,导致全年的总投诉量和解决数量都有所下降。

同时,论坛继续在关键地区引入新的经纪商成员,并在市场波动不稳与地缘政治不确定性持续扩大的一年中,致力于保护交易者免受在线骗局的影响。

2023年关键亮点与成就

其他2023年度关键指标

年度投诉总结报告下载链接

关键要点总结

结论

金融委员会在2023年继续优化针对交易者和经纪商成员的快速高效的争议解决服务。全球市场价格波动加剧及地缘政治不确定性增加刺激了在线交易的兴趣,使得2023年与交易相关的投诉份额有所上升。通过改进与经纪商成员之间的投诉提交流程,今年整体投诉量下降,其中非交易类投诉的比例较上年下降了65%,有助于交易者更快地通过经纪商解决纠纷。

组织进一步扩大了会员规模,特别是在亚洲地区增加了新成员。免费提供给交易者的争议解决服务在亚洲地区依然受到欢迎,该地区的新投诉占比达到46%。值得指出的是,纠纷调解论坛在中东地区的知名度提升,新投诉占比达24%,同时在拉丁美洲也取得进展,占2023年投诉的10%。来自非洲国家的投诉增长了16%,反映出零售交易在此区域日益流行。

2023年的大多数投诉与财务问题相关(占总数的49%),交易相关纠纷占比23%,非交易相关投诉占比29%。最常出现投诉主题包括资金提取(41%)、账户封锁(24%)、价格核对(11%)、平台问题(5%)和强制平仓订单(3%)。已解决的所有投诉中,32%被裁定“有利于经纪商”,12%“有利于客户”,而56%的投诉被认定超出组织管辖范围。交易者胜诉的比例比上一年提高了30%。

展望2024年,金融委员会预计全球范围内对交易和投资的需求将持续增长,尤其是年轻交易者群体,由于财政和地缘政治风险影响货币、商品(特别是黄金和股票)的价格走势,组织准备应对年内可能增加的来自交易者的投诉数量。

关于金融委员会

金融委员会是一个独立的外部争议解决(EDR)机构,专门为无法直接与其金融服务提供商(这些提供商是金融委员会成员)解决争议的消费者/交易者提供服务。起初,金融委员会旨在为交易者和经纪商提供一种新的方式来解决电子市场交易过程中产生的任何问题,如外汇交易,后来扩展到了差价合约(CFDs)及相关衍生品领域,并开始认证用于交易的技术平台。

如需更多信息,请通过[email protected]联系我们。

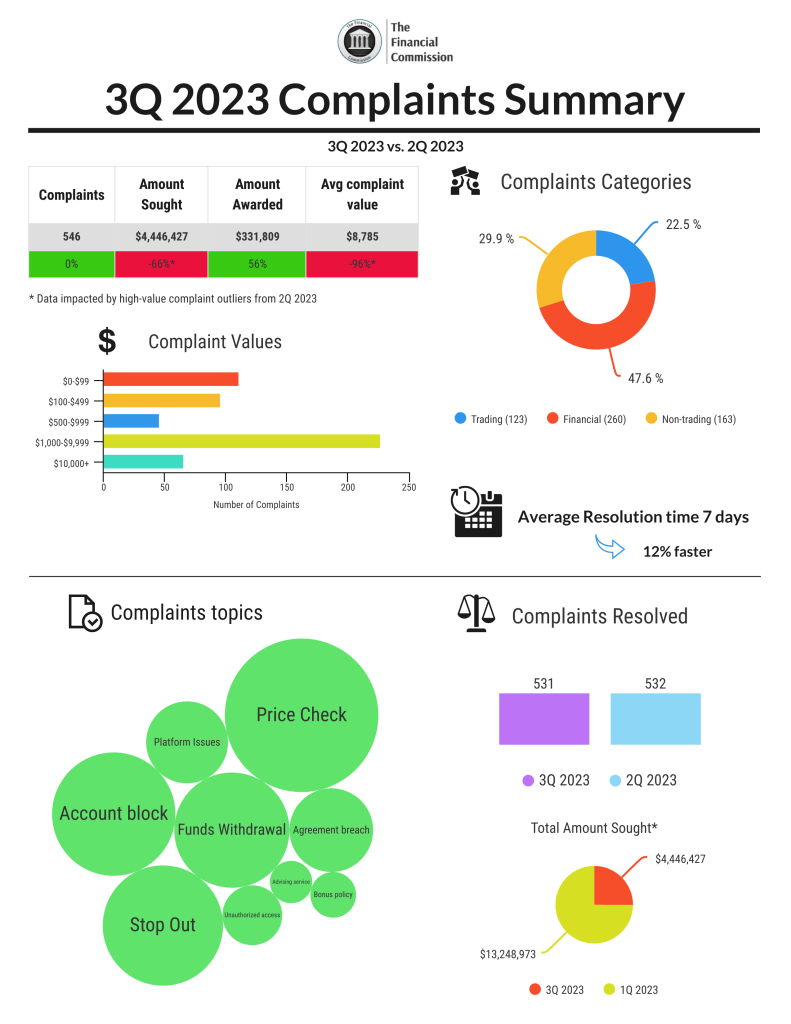

金融委员会,作为一家领先的独立非政府性自律组织及外部争议解决(EDR)论坛,在其发布的2023年第三季度投诉摘要中宣布了多项关键运营指标的增长情况。其中包括向交易者赔付的金额增多、与交易相关的投诉数量上升等。同时,该组织记录到纠纷解决效率提高,平均每个投诉案件在7.1天内得到解决。

为了坚守保护交易者免受潜在诈骗、庞氏骗局和网络欺诈活动侵害的核心原则,金融委员会本季度已将38个网站列入警告名单,并对克隆网站和假冒代表进行了识别并发布了公开警告。

以下是2023年第三季度相较于第二季度的关键亮点对比:

季度间对比总结

Quarterly Comparison

要点总结:

结论

金融委员会在持续的价格区间波动和高利率环境下,继续接收到来自交易者的稳定投诉量。具体来说,在本季度中,新提交的投诉数量以及解决的总投诉数量几乎未发生实质性变化。然而,由于上一季度解决了几起高额投诉,所以索赔总额、赔付给交易者的金额及平均投诉价值均发生了显著变化。其中,本季度向交易者索赔的总额为440万美元,较第二季度下降了66%;而给予交易者的赔偿金额则显著提升至331,809美元。此外,高价值投诉类别也大幅增加,价值在1千至1万美元之间的投诉量环比增长141%,而价值超过1万美元的投诉量增长了29%。

在这一期间,关于交易相关(环比增长7%)和非交易相关(环比增长4%)投诉的主题明显增多,这表明即使在外汇和差价合约市场可能存在较小价格波动范围内,交易者仍在积极寻找交易机会。

在此期间,争议解决委员会(DRC)成功减少了17%需延续到第三季度处理的投诉调查,并且平均解决时间有所提高。

关于金融委员会

金融委员会是一个独立的外部争议解决(EDR)组织,专门服务于无法直接与会员金融服务提供商解决纠纷的消费者/交易者。该委员会最初旨在为交易者和经纪商提供一种新的方式,解决电子市场交易过程中出现的问题,如外汇交易,并随后扩展到涵盖差价合约(CFDs)及相关衍生品领域,同时还对用于交易的技术平台进行认证。

欲了解更多详情,请通过[email protected]联系我们。

2023年7月10日,作为领先的独立非政府性自律组织及外部争议解决(EDR)论坛的金融委员会,在其季度投诉摘要中宣布了多个关键运营指标的增长,包括交易者寻求和获得的赔偿金额、与交易相关的投诉数量以及平均投诉价值等。同时,该组织也记录到纠纷解决时间有所延长,平均需要8天来解决一起投诉。

为了坚守保护交易者免受潜在网络诈骗、庞氏骗局以及欺诈活动侵害的核心原则,金融委员会在本季度已将超过45个网站列入警示名单,并针对克隆网站和虚假代表发出了公开警告。

2023年第二季度对比第一季度的关键数据亮点如下:

季度环比对比情况总结

关键要点总结:

结论

2023年第二季度,由于全球范围内利率上调步伐放缓甚至在某些情况下暂停以及通胀可能得到遏制,导致市场波动性持续减弱,这影响了零售交易者投资行为,并引发了金融委员会多项关键指标的变化。具体而言,该组织在本季度新提交投诉量环比下降3%,同时解决的投诉总量也减少了7%。然而,投诉涉及的索赔金额和赔偿额度、平均投诉价值均飙升至显著高位。虽然部分统计受少数高净值客户大额投诉的影响,但整体增长表明今年向金融委员会论坛提交的投诉价值持续增加,对公正、独立且深入调查此类纠纷的需求显然也在同步增长。

此外,在此期间,投诉主题也有明显增多,其中与交易相关的投诉(环比增长6%)和财务相关的投诉(增长4%),表明即使在外汇和差价合约市场可能出现较小的价格区间内,交易者仍在不断寻找交易机会。

尽管在本季度中,争议解决委员会(DRC)成功减少了积压至第二季度处理的投诉调查数量,但由于这段时间内交易相关投诉调查的复杂性和耗时较长,导致平均解决时间有所上升。

关于金融委员会

自2013年以来,金融委员会作为一个独立的非政府性自律组织及外部争议解决(EDR)论坛,专门为外汇和差价合约交易者以及经纪商会员公司提供纠纷调解服务。欲了解更多详情,请点击此处或通过电子邮件[email protected]联系我们。

April 4th 2023, The Financial Commission, a leading external dispute resolution (EDR) organization catering to the financial services industry, announces increases in several key metrics, including new and resolved complaints, amounts sought from non-members and those awarded to traders, as well as rise in financial-related complaints, as part of its quarterly Complaints Digest. The organization also recorded improved resolution times, with complaints being resolved on average in 5.6 days.

Key highlights for 1Q 2023 vs. 4Q 2022:

Quarter Over Quarter Comparison

Key Takeaways

Conclusions

The return of market volatility, as well as sustained macro trends, including rising interest rates, inflation and geopolitical concerns boosted retail trading among investors in the first quarter of 2023 and impacted several key metrics of the Financial Commission. There was also noticeable change in the complaints topics for the period, with increases in trading-related and financial-related complaints, which indicate that traders are back to finding opportunities in the markets. In 1Q 2023 the organization also experienced an increase in amounts sought from non-member firms, indicating the significant number of investors, who do not have access to external dispute resolution (EDR) services today. Complaints filed and resolved in the first quarter of 2023 were also more valuable, with those in the $500-999 and $1,000-9,999 categories increasing 48% and 54%, respectively – highlighting the continued importance of the organization to investigate complaints with higher monetary values. During the quarter, the Dispute Resolution Committee (DRC) managed to accumulate less complaint investigations carrying over into 2Q, while experiencing an improvement in already exceptional average resolution times, which still continue to outpace alternative EDR services.

About Financial Commission

The Financial Commission has conducted dispute resolution services specifically for FX and CFD traders and broker member firms since 2013 as an independent, non-governmental self-regulatory organization and external dispute resolution (EDR) forum. For more information, click here or email us at [email protected].

January 25th, 2023, The Financial Commission today announces the results of its operations for the previous year with the publication of the 2022 Complaints Summary. The organization achieved record annual growth in key metrics, including new complaints filed and resolved during the year, while achieving an all-time record for quickest and efficient average dispute resolution time since 2013. The organization also continued to bring on new broker members in key regions during a year of rising market volatility and geopolitical uncertainty.

New records set in 2022

Other key metrics & accomplishments in 2022

Annual Complaints Summary

Key Takeaways

Conclusions

The Financial Commission improved its already quick and efficient dispute resolution services to traders and broker members in 2022. New global market price volatility and geopolitical uncertainty provided for a renewed interest in online trading, leading to a record amount of new complaints for the organization, as well as improved operational metrics.

The organization further expanded its membership ranks with large, internationally recognized brokers, as well as new members in the Asia region. The organization’s free dispute resolution service to traders gained popularity in Asia, Latin America and Europe with new complaints from these regions growing 47%, 38% and 30% respectively, while complaints from the Middle East grew moderately at 15% in 2022. The Financial Commission also saw a continued decrease of 38% in complaints from Russia and former Soviet republics, as local market restrictions remained in place.

The majority of complaints in 2022 were related to non-trading issues with 58% of the total, while financial related disputes accounted for 29% and trading related complaints 13%. The most popular topics for complaints dealt with account blocking (29%), funds withdrawal (19%), price check (14%), non-market quotes (7%) and stop-out orders (6%). Of all resolved complaints, 42% were resolved “in favor of the broker” and 16% resolved “in favor of the client”, while 52% were found to be outside the organization’s jurisdiction.

Heading into 2023, the Financial Commission expects to see healthy global demand for trading and investing, particularly among younger traders, with fiscal and geopolitical risks impacting the prices of commodities, equities and digital assets through the year. In this regard the organization is prepared to handle a further growth in the number of new complaints from traders during the year.

About Financial Commission

Founded in 2013, the Financial Commission is a leading independent member-driven external dispute resolution (EDR) organization for international online brokerages, exchanges and Blockchain firms that participate in global foreign exchange (forex), derivatives, CFD and digital asset markets.

The Financial Commission provides efficient compliance solutions to its members, alongside its External Dispute Resolution (EDR) mechanism that serves as an effective channel for processing complaints from clients of member firms.

For more information please contact us at [email protected].

January 25th, 2023, The Financial Commission today announces the results of its operations for the previous year with the publication of the 2022 Complaints Summary. The organization achieved record annual growth in key metrics, including new complaints filed and resolved during the year, while achieving an all-time record for quickest and efficient average dispute resolution time since 2013. The organization also continued to bring on new broker members in key regions during a year of rising market volatility and geopolitical uncertainty.

New records set in 2022

Other key metrics & accomplishments in 2022

Annual Complaints Summary

Key Takeaways

Conclusions

The Financial Commission improved its already quick and efficient dispute resolution services to traders and broker members in 2022. New global market price volatility and geopolitical uncertainty provided for a renewed interest in online trading, leading to a record amount of new complaints for the organization, as well as improved operational metrics.

The organization further expanded its membership ranks with large, internationally recognized brokers, as well as new members in the Asia region. The organization’s free dispute resolution service to traders gained popularity in Asia, Latin America and Europe with new complaints from these regions growing 47%, 38% and 30% respectively, while complaints from the Middle East grew moderately at 15% in 2022. The Financial Commission also saw a continued decrease of 38% in complaints from Russia and former Soviet republics, as local market restrictions remained in place.

The majority of complaints in 2022 were related to non-trading issues with 58% of the total, while financial related disputes accounted for 29% and trading related complaints 13%. The most popular topics for complaints dealt with account blocking (29%), funds withdrawal (19%), price check (14%), non-market quotes (7%) and stop-out orders (6%). Of all resolved complaints, 42% were resolved “in favor of the broker” and 16% resolved “in favor of the client”, while 52% were found to be outside the organization’s jurisdiction.

Heading into 2023, the Financial Commission expects to see healthy global demand for trading and investing, particularly among younger traders, with fiscal and geopolitical risks impacting the prices of commodities, equities and digital assets through the year. In this regard the organization is prepared to handle a further growth in the number of new complaints from traders during the year.

About Financial Commission

The Financial Commission has conducted dispute resolution services specifically for FX and CFD traders and broker member firms since 2013 as an independent, non-governmental self-regulatory organization and external dispute resolution (EDR) forum. For more information, click here or email us at [email protected].

January 16th 2023, The Financial Commission today announces increases in several key metrics, including amounts sought from broker members and average complaint values, as well as rise in trading-related complaints as part of its quarterly Complaints Digest. The organization experienced a slowdown in new and resolved complaints, amounts sought from non-member brokers and complaints ruled in favor of traders in the 4th quarter of the year.

Key highlights for 4Q vs. 3Q 2022:

Quarter Over Quarter Comparison

Key Takeaways

Conclusions

Range bound forex and derivatives prices, as well as winter holidays impacted several key metrics of the Financial Commission in the final quarter of 2022. Slowdowns in filed and resolved complaints, as well as compensation sought suggest traders may be finding less opportunities on traditional markets in light of range bound price fluctuations or simply forwent trading at the end of the year. In 4Q 2022 the organization also experienced a drop in most amounts sought metrics, except those attributed to members. There was a noticeable change in the complaints topics for the period, with trading-related complaints rising 5% month-over-month despite the general drop in new complaints for the quarter. Complaints listed in the value category $1-10K and $10K+ increased their overall share of complaints 5%, highlighting the continued importance of the organization to investigate complaints with higher monetary values. During the quarter, the Dispute Resolution Committee (DRC) managed to accumulate less complaint investigations carrying over into the New Year, as compared to 3Q, while experiencing a rise in already exceptional average resolution times, which still continue to outpace alternative EDR services.

About Financial Commission

The Financial Commission has conducted dispute resolution services specifically for FX and CFD traders and broker member firms since 2013 as an independent, non-governmental self-regulatory organization and external dispute resolution (EDR) forum. For more information, click here or email us at [email protected].

October 4th 2022, The Financial Commission today announces increases in several key metrics, including amounts sought and awarded to traders, as well as improved dispute resolution times as part of its quarterly Complaints Digest. The organization experienced a rise in new and resolved complaints, amounts sought from non-member brokers, average complaint values and complaints ruled in favor of traders in the 3rd quarter of the year.

Key highlights for 3Q vs. 2Q 2022:

Quarter Over Quarter Comparison

Key Takeaways

Conclusions

Renewed focus on forex and derivatives trading following weak cryptocurrency prices among investors impacted several key metrics of the Financial Commission in the third quarter of 2022. Renewed growth in filed and resolved complaints, as well as compensation sought suggest traders may be taking advantage of price volatility on traditional markets in light of the negative impact to such asset classes as digital currencies. In 3Q 2022 the organization also experienced growth of all amounts sought metrics, including total amounts sought and those only attributed to members and non-members. There was a significant change in the complaints topics for the period, with financial complaints rising 54% and non-trading complaints falling by 13% of all new complaints for the period. Complaints listed in the value category $1-10K jumped 25%, highlighting the continued importance of the organization to investigate complaints with higher monetary values. During the quarter, the Dispute Resolution Committee (DRC) accumulated more complaint investigations carrying over into 4Q 2022 due to the complex nature of the dispute subjects, while nonetheless improving already exceptional average resolution times, which still continue to outpace alternative EDR services.

About Financial Commission

The Financial Commission has conducted dispute resolution services specifically for FX and CFD traders and broker member firms since 2013 as an independent, non-governmental self-regulatory organization and external dispute resolution (EDR) forum. For more information, click here or email us at [email protected].

July 27th, 2022, The Financial Commission today announces its operating metrics for the first half of 2022 as part of its ongoing Complaints Digest publications highlighting the organization’s performance. Continued interest in trading among investors has led to a steady rise in some key metrics of the dispute resolution service of the organization, while average dispute resolution times continued to improve. The organization also added 6 new broker members and certified one platform provider during this period.

Key Half Year Highlights (as compared to 2H 2021):

A Detailed Summary

Key Takeaways for 1H 2022

Conclusions

The Financial Commission continues to effectively resolve traders’ disputes and public inquiries during continued market volatility around the world, with total resolved complaints for the 1st half of 2022 being 6% higher than 2H 2021. The drop in average complaints values and changes in the complaints value categories suggest that many new investors have entered the market on the heels of significant equity and crypto market growth that occurred in the later stages of 2021.

The Dispute Resolution Committee witnessed a rise in compensation sought from member brokers of 26%, indicating the rise in demand for trading services among Financial Commission members, while also experiencing a drop of 66% in compensation sought from non-members, suggesting that warnings and notices issued regularly by the Financial Commission and financial regulators worldwide may be deterring investors from becoming victims of untrustworthy companies and exchanges.

The continued effectiveness of the dispute resolution service is also highlighted by the 12% rise in member complaints for the half year. “Non-trading related” complaints continue to grow with a 5% uptick to 1112 in this time period, highlighting the broad scope of issues experienced by traders today. The highest trending complaints topics included account blocking, withdrawal of funds and price check requests further highlighting the continued interest in trading FX and CFD markets by traders of all experience levels.

About Financial Commission

The Financial Commission has conducted dispute resolution services specifically for FX and CFD traders and broker member firms since 2013 as an independent, non-governmental self-regulatory organization and external dispute resolution (EDR) forum. For more information, click here or email us at [email protected].

April 20th 2022, The Financial Commission today announces increases in new filed and resolved complaints, as well as amounts sought from broker members as part of its quarterly Complaints Digest. The organization also experienced a slight uptick ini already swift average dispute resolution times, with a 6.3 days average for the quarter.

Key highlights for 1Q 2022:

Quarter Over Quarter Comparison

Key Takeaways

Conclusions

Demand for retail trading continued to impact several key metrics of the Financial Commission in the first quarter of 2022. An increase in newly filed complaints and increases in resolved complaints suggest traders are continuing to try and take advantage of market opportunities with the Dispute Resolution Committee (DRC) continuing to process a significant amount of complaints in the first quarter of the year. The DRC was able to award a smaller amount of compensation to traders than in the previous quarter while experiencing a jump in the amounts sought by traders from broker members during this time. Financial-related complaints increased by 40%, which indicates a significant rise in disputes related to funds withdrawal. At the same time, complaints listed in the most valuable category ($10K+) jumped 70% in 1Q 2022, highlighting the continued importance of the organization to investigate complaints with a significant monetary value. During the quarter, the DRC was able to resolve 3% more complaints than in the previous period with fewer complaint investigations and decisions carried over into 2Q 2022, while maintaining exceptional average resolution times, which still continue to outpace alternative EDR services.

About Financial Commission

The Financial Commission has conducted dispute resolution services specifically for FX and CFD traders and broker member firms since 2013 as an independent, non-governmental self-regulatory organization and external dispute resolution (EDR) forum. For more information, click here or email us at [email protected].

January 17, 2022, The Financial Commission today announces the results of its operations for the previous year with the publication of the 2021 Complaints Summary. The organization achieved record annual growth in key metrics, as well as continued membership expansion during another challenging year impacted by the Covid-19 pandemic while maintaining a quick and efficient average dispute resolution time.

New records set in 2021

Other key metrics & accomplishments in 2021

Annual Complaints Summary

Key Takeaways

Conclusions

The Financial Commission continued to provide quick and efficient dispute resolution services to traders and broker members in 2021 despite continued global disruptions related to Covid-19. Continued demand from retail traders and new investors provided for a record amount of new complaints for the organization and led to new records in operational metrics.

The organization further expanded its membership ranks with large, internationally recognized brokers, as well as new members in the Middle East region. The organization’s free dispute resolution service to traders gained popularity in Asia, Latin America and Europe with new complaints from these regions growing 98%, 87% and 20% respectively, while complaints from the Middle East grew substantially by 357% in 2021. The Financial Commission also saw a continued decrease of 47% in complaints from Russia and former Soviet republics, as local market restrictions continued to impede the normal online trading operations FX and CFD traders had come to expect in the past.

The majority of complaints in 2021 were related to non-trading issues with 58% of the total, while financial related disputes accounted for 23% and trading related complaints 19%. The most popular topics for complaints dealt with account blocking (32%), funds withdrawal (17%), price check (13%), non-market quotes (8%) and stop-out orders (6%). Of all resolved complaints, 59% were resolved “in favour of the broker” and 10% resolved “in favour of the client”, while 30% were found to be outside the organization’s jurisdiction.

Heading into 2022, the Financial Commission expects to see global demand for trading and investing services continue to rise, particularly among younger generations of trades, with opportunities for volatility in prices of financial products, including commodities, energies and equities as a result of changes in fiscal economic policies and impacts from the ongoing Covid-19 pandemic. In this regard, the organization is prepared to handle a growing number of new complaints from traders in the New Year.

About Financial Commission

The Financial Commission has conducted dispute resolution services specifically for FX and CFD traders and broker member firms since 2013 as an independent, non-governmental self-regulatory organization and external dispute resolution (EDR) forum. For more information, click here or email us at [email protected].

January 10th 2022, The Financial Commission today announces increases in amounts sought from brokers and average values of complaints in the last month of the year as part of its monthly Complaints Digest. The organization also experienced a continued improvement in already swift average dispute resolution times, with a 5.3 days average for the month.

Key monthly highlights for December 2021:

Month Over Month Comparison

Key Takeaways

Conclusions

The Financial Commission Dispute Resolution Committee (DRC) did not experience a shortage of complaints heading into the end of 2021 as retail traders continued to find trading opportunities in global markets. The DRC continued to process a significant amount of complaints that grew steadily over the previous months. The DRC was able to award a smaller amount of compensation to traders than in the previous month while experiencing a significant jump in the amounts sought by traders from non-member brokers in December. Roughly 16% of new complaints filed with the DRC in December were valued between $1,000-$10K+, highlighting the continued importance of the organization to investigate complaints with a significant monetary value.

About Financial Commission

The Financial Commission has conducted dispute resolution services specifically for FX and CFD traders and broker member firms since 2013 as an independent, non-governmental self-regulatory organization and external dispute resolution (EDR) forum. For more information, click here or email us at [email protected].

December 8th 2021, The Financial Commission today announces increases in amounts sought from brokers, average values of complaints, as well as total resolved complaints for November 2021 as part of its monthly Complaints Digest. The organization also experienced a significant improvement in already swift average dispute resolution times, with a 6 days average for the month.

Key monthly highlights for November 2021:

Month Over Month Comparison

Key Takeaways

Conclusions

Demand for retail trading continues to impact several key metrics of the Financial Commission for November 2021. Relatively lower numbers for newly filed complaints and increases in resolved complaints suggest traders are continuing to try and take advantage of market opportunities with the Dispute Resolution Committee (DRC) continuing to process a significant amount of complaints in the last quarter of the year. The DRC was able to award a smaller amount of compensation to traders than in the previous month while experiencing a jump in the amounts sought by traders from broker members in November. At the same time, over 22% of all new complaints filed with the DRC in November were valued between $1,000-$10K+, highlighting the continued importance of the organization to investigate complaints with a significant monetary value. During the month, the DRC was able to resolve 2% more complaints than in October with some complaint investigations and decisions carrying over into November, while improving average resolution times, which still continue to outpace alternative EDR services.

About Financial Commission

The Financial Commission has conducted dispute resolution services specifically for FX and CFD traders and broker member firms since 2013 as an independent, non-governmental self-regulatory organization and external dispute resolution (EDR) forum. For more information, click here or email us at [email protected].

November 8th 2021, The Financial Commission today announces increases in amounts awarded to traders, as well as amounts sought from member brokers in October 2021 as part of its monthly Complaints Digest. The organization also experienced a significant improvement in already swift average dispute resolution times, with a 6.8 days average for the month.

Key monthly highlights for October 2021:

Month Over Month Comparison

Key Takeaways

Conclusions

Demand for retail trading and investing looks to be continuing judging by several key metrics of the Financial Commission for October 2021. Steady numbers for filed and resolved complaints suggest traders are continuing to try and take advantage of market opportunities with the Dispute Resolution Committee (DRC) continuing to process a larger number of complaints than in the summer months. The DRC was able to award a larger amount of compensation to traders than in the previous month while experiencing a jump in the amounts sought by traders from broker members in October. At the same time, over 23% of all new complaints filed with the DRC in October were valued between $1,000-$10K+, highlighting the continued importance of the organization to investigate complaints with a significant monetary value. During the month, the DRC was able to resolve 8% fewer complaints than in September with some complaint investigations and decisions carrying over into November, while improving average resolution times, which still continue to outpace alternative EDR services.

About Financial Commission

The Financial Commission has conducted dispute resolution services specifically for FX and CFD traders and broker member firms since 2013 as an independent, non-governmental self-regulatory organization and external dispute resolution (EDR) forum. For more information, click here or email us at [email protected].

October 18th 2021, The Financial Commission today announces increases in newly filed complaints, resolved complaints, as well as amounts sought by traders and average complaints values for September 2021 as part of its monthly Complaints Digest. The organization also experienced a slight slowdown in already swift average dispute resolution times, with 9.4 days average for the month.

Key monthly highlights for September 2021:

Month Over Month Comparison

Key Takeaways

Conclusions

Demand for retail trading and investing looks to have picked up following the summer months as highlighted by the growth of several key metrics of the Financial Commission for September 2021. Increases in new filed and resolved complaints suggest traders are continuing to try and take advantage of market opportunities with the Dispute Resolution Committee (DRC) continuing to process a larger number of complaints than previous months. The DRC was able to award a smaller amount of compensation to traders in the previous month while experiencing a significant jump in the amount sought in all submitted complaints. At the same time, over 23% of all new complaints filed with the DRC in September were valued between $1,000-$10K+, highlighting the continued importance of the organization to investigate complaints with a significant monetary value. During the month, the DRC was able to resolve 33% more complaints than in August with continued operating efficiencies, while the rise in newly filed complaints led to an uptick in average resolution times, which still continue to outpace alternative EDR services.

About Financial Commission

The Financial Commission has conducted dispute resolution services specifically for FX and CFD traders and broker member firms since 2013 as an independent, non-governmental self-regulatory organization and external dispute resolution (EDR) forum. For more information, click here or email us at [email protected].