May 19th, 2023, The Financial Commission, a leading external dispute resolution (EDR) organization catering to the financial services industry, announces a public warning against a clone website (https://insecreg.com/) that mimics The Financial Commission in an attempt to defraud Forex traders.

The Financial Commission took immediate steps to block the clone website and filed a claim with the domain registrar to take ownership of the all-too-similar domain address to ensure that traders are always accessing official materials of The Financial Commission. Moreover, The Financial Commission takes all necessary actions, including reporting to law-enforcement authorities and initiation of legal proceedings against “catfish”, in order to protect and prevent all fraudulent activities against its clients in the future.

We remind the trading community that the Financial Commission services for traders are 100% free and our representatives will contact broker clients by phone or email only in response to an inbound inquiry received on our website and social media pages. The Financial Commission absolutely does not solicit payments or fees for its services from traders.

The great lengths that companies may go to help perpetrate a fraud can be difficult for even the most cautious investors to detect. Be sure that the .org suffix is at the end of the URL when searching for our website, or clicking on related links when attempting to visit https://financialcommission.org and contact us to verify any email you receive from anyone claiming to be affiliated with the Financial Commission.

About The Financial Commission

The Financial Commission is an independent external dispute resolution (EDR) organization for consumers/traders who cannot resolve disputes directly with their financial services providers that are members of The Financial Commission. The Financial Commission initially set out to provide a new approach for traders and brokers alike to resolve any issues that arise during trading electronic markets such as Foreign Exchange. Then it expanded into CFDs and related derivatives, in addition to certifying technology platforms used for trading.

According to a recent report from Finance Magnates, Contracts for Difference (CFDs) are having a hard time at adoption in younger regional regulatory regimes. The news portal reported that IG Group’s South African entity has had trouble bringing CFDs onboard for client trading primarily due to the fact that South Africa’s Financial Sector Conduct Authority (FSCA) does not regulate such financial products at the moment.

IG Group’s local entity is indeed licensed by the FSCA to provide execution only service, but it has not been able to receive any status to offer OTC derivatives – the category of CFDs. The broker has applied for such authorizations back in 2019, but was denied. Now the broker has filed an appeal and interestingly enough, the regulator has given IG Group a temporary exemption from “Regulation 2(1)(a) of the FMA Regulations”, meaning that existing customers may actually be able to trade CFDs for the time being.

During the exemption period the broker must disclose certain information and metrics relating to existing clients’ trading of CFDs. Nonetheless, it remains to be seen if the broker can achieve a breakthrough in getting authorization to provide CFD trading on a full-time basis, given the regulator’s current classification of CFDs as OTC derivatives “on a principal-to-principal basis”.

With CFD restrictions looming in Australia in the spring of 2021 and already existing regimes that have tightened restrictions on CFD trading in the UK and Europe, the current situation with IG Group’s South African entity could be a “make it or break it” moment for such OTC derivatives adoption in regional markets with relatively new regulatory regimes at a time when many retail OTC brokers are looking to such regions for expansion.

Don’t miss the latest news and discussion on our Telegram channel. Subscribe today

The retail US Forex market saw mixed results when looking at retail client deposits – a metric provided by the US Commodity Futures Trading Commission. In November 2020 all registered US FX brokers gained only $1,810,875 in new retail client deposits. Newcomer IG US experienced a 3% rise, while veteran broker GAIN Capital Group slipped 2% or $5.2 million for the month.

The biggest gain was experienced by Interactive Brokers, which increased its retail FX deposits by a strong 20% with $11,857,929 added. Both OANDA and TD Ameritrade experienced slight dips of -2% and -1% respectively.

The lackluster growth in retail deposits during some expected market volatility around the US election and Covid-19 vaccine approvals suggests to us that US investors may have been more attracted to volatility in equity markets, which had gained immense popularity in 2020 with low-cost accounts offered by equity brokerages, including those with no trade commissions.

In a further sign of what impacts Brexit is having on financial service providers with no passporting rights left in place since the divorce of the UK and EU on December 31st, IG Group’s UK entity has informed its European clients that they must migrate their accounts to IG Europe in order to continue trading.

In a blog post on its website, the broker indicated that customers have to agree to transfer their accounts by January 8th, 2021, and provide KYC documents in order to confirm their identity and continue trading in a European domiciled account. At the same time, the broker is promising to re-establish any open traders or orders in the customers’ new accounts if they agree to the transfer.

Since client funds will be held in accordance with “BaFin’s client money rules” customers accounts are expected to be regulated by the German financial regulator and there is no word yet on any impacts to leverage, commissions, or other trade settings provided to customers when they were trading via the UK. Given that no passporting rights between the UK and EU exist at the moment, we expect more UK domiciled brokers to announce migrations of customers back to mainland Europe.

Don’t miss the latest news and discussion on our Telegram channel. Subscribe today

In an effort to educate the public of the ongoing problem with online investment and trading scams, often highlighted by our organization, the Malaysian Securities Commission (SC) has published a note guiding citizens on how to approach any possible investment or trading advisors that may try to solicit business.

The regular indicated that it has seen an “increasing number of queries and complaints received regarding various social media, chat rooms and messaging applications that appear to be providing specific stock recommendations and/or investment advice to members of the public, who are given access to these recommendations and/or advice upon payment of a fee.”

Specific to Malaysian residents, the regulator said that “investors are reminded to verify the licensing status of platforms, companies, and individuals offering capital market services or products, including the provision of investment advice, before making any investment decision. Information on persons licensed or registered by the SC can be found at the Public Register of License Holders www.sc.com.my/licensed-registered-persons and List of Registered Recognised Market Operators www.sc.com.my/rmo.”

The regulator also reiterated stiff penalties for those individuals who are “carrying on a business of giving investment advice without a license”. Such offenses, the SC says are “punishable with a fine not exceeding RM10 million or imprisonment not exceeding ten years or both, if found guilty.”

With the European Union and United Kingdom swiftly approaching the end of the Brexit transition period on December 31, 2020, and no immediate relief is provided in the so-called “Brexit Deal”, brokers licensed in the UK will lose passporting rights on January 1st and will not be able to service European traders vis-a-vis their UK operations.

IG Group, the major multinational brokerage announced to its European traders domiciled at IG’s UK entity several hours ago that it will not be able to continue to provide trading services following the end of 2020 due to the lack of passporting rights. The broker invited customers to transfer their accounts to “IG Europe to keep trading CFDs with IG. IG Europe is based in Germany and is authorized and regulated by BaFin and Bundesbank. It offers a range of financial products depending on your location, including CFDs, options, and turbos.”

The broker indicated that all open orders and positions after 31 December will be placed on closings only until the customer’s accounts are successfully transferred. The broker expects the transfer to happen in mid-January and there is no word on what approval process needs to take place to open accounts at IG’s german entity at this point.

Some may recall that several UK based brokers have registered new entities in European countries, including Pepperstone in Cyprus, in order to continue servicing EU traders with little to no interruptions. It remains to be seen if any relief will be provided by ESMA or other EU financial authorities in order to ensure smooth transitions for European traders.

Don’t miss the latest news and discussion on our Telegram channel. Subscribe today!

According to the Israeli technology news site Ctech, the social trading and multi-asset brokerage eToro is eyeing an initial public offering (IPO) in the second quarter of 2021 following stellar growth in 2020 with a doubling of revenue and addition of 5 million new customers.

The technology news site reports that eToro is looking to book Goldman Sachs as its leading bank for the offering. Founded in 2007 by two brokers, the company has grown into an international social trading and brokerage powerhouse. The company is reported to have booked revenue of $500 million during the difficult pandemic year and has experienced a sharp rise in the number of new customers.

If the brokerage does list on an exchange, it would join a long list of successful Israeli firms that have already done so or are also planning to list on US equities exchanges. At the same time, representatives of eToro signaled that the news is just a ‘rumor’ having commented to Finance Magnates, that “eToro does not comment on market rumors.”

Don’t miss the latest news and discussion on our Telegram channel. Subscribe today!

Interactive Brokers asks its Eastern European clients to transfer their accounts to the newly formed Hungarian subsidiary Interactive Brokers Central Europe Zrt.

The brokerage company is sending emails to its clients across Eastern Europe requesting their permission to transfer accounts from the UK regulated office (IBUK) to a new branch recently launched in Budapest (IBCE). The company attributed this move to the approaching expiration of the transition period for Brexit.

The message says that since IBUK’s “passport rights” expire at the end of the year, the service for its clients will be transferred to the European dealership starting from January 1, 2021.

Meanwhile, it is not yet clear whether such invitations are received by the clients of the European Union jurisdiction, or whether it is only about residents of Eastern Europe. Moreover, Interactive Brokers also has an active representative office in Luxembourg.

As a reminder, US trading giant Interactive Brokers Group, as part of its development strategy, launched a subsidiary in Hungary called Interactive Brokers Central Europe Zrt (IBCE) literally at the beginning of this month.

“The opening of an office in Budapest is taking place against the backdrop of growing demand in the Central European region,” the company said earlier.

“We plan to make Budapest the center of our operations in Central Europe to meet the increased demand for brokerage services in Western and Eastern Europe and around the world. We strive to bring knowledge and understanding of capital markets to our future clients throughout Central Europe,” added then Thomas Peterffy, Chairman of Interactive Interactive Brokers.

Don’t miss the latest news and discussion on our Telegram channel. Subscribe today!

The latest data for October 2020 from the Commodity Futures Trading Commission for Futures commission merchants (FCMs) and retail foreign exchange dealers (RFEDs) shows the continued success of IG US LLC – the recently launched US entity of London-based online trading juggernaut, IG Group. At the same time, the data shows a noticeable outflow of customer funds from Interactive Brokers (IBKR), which just yesterday experienced major trading outages affecting equities trading.

IG US was able to raise client funds in the amount of $2,036,138 or 9% month-over-month compared to September 2020. Meanwhile, Interactive Brokers lost $4,678,920 in customer deposits for the same period, or a drop of 7% MoM. Both OANA and TD Ameritrade experienced slight increases in customer assets up 2% and 1% respectively. GAIN Capital Group, now part of StoneX for its part experienced a non-material change in customer assets with a $612,429 decrease.

The overall customer assets picture did not change much from September, as a net $875,902 of new monies was deposited across all registered FCMs in the United States.

In what seems like a regular occurrence as of late, individual equities trading providers Interactive Brokers and Robinhood have experienced major trading outages this morning during the European and US sessions, as reported by FinanceMagnates. There has been a renewed demand for single stock equities by traders primarily in the United States and Europe in 2020, as the Covid-19 pandemic and now a rush to vaccinate major populations has continued to impact global markets.

Interactive Brokers reported to clients that “they experienced “a significant failure” in multiple segments of a highly resilient data storage system” which lead to customers being unable to “connect through their web, mobile, and desktop trading platforms.” As of this post, some individual traders are reporting that things are returning to normal, while others are signaling that their online trading capabilities are still down.

While Robinhood did not provide any reported feedback to customers and their public-facing information states, many clients have reported that they are also experiencing server connection problems.

Traders are advised to employ traditional means of communication during such adverse events, including calling their brokerages directly or using online chat with customer support in order to manage trading orders and positions. Often times, it is the responsibility of the trader to ensure that they have ample margin and account balance to support any open trades or orders irrespective of access to their online trading platform.

Australia licensed broker USGFX has informed clients that it is unlikely to be able to return client funds as previously scheduled as part of its liquidation process, which began earlier this year. According to Finance Magnates, the issue stems from the migration of AU domiciled customers into the broker’s Vanuatu entity.

For reasons not disclosed by the broker, other than “restrictions imposed by the regulator on business” by Vanuatu financial authorities, customers of the troubled brokerage will unlikely see their funds by the end of the calendar year. Nonetheless, the broker has assured the public that operations at its Vanuatu branch continue as normal.

It remains to be seen if Australia’s Securities and Investments Commission will step in to provide any relief to AU domiciled clients who are experiencing a delay and why the issue of client withdrawals en masse has come up in the first place. With both jurisdictions have financial regulatory bodies tasked with resolving such situations in the interest of customers, little has been disclosed so far as to how the agencies are working to resolve the matters quickly for retail traders.

According to its latest press release with October 2020 metrics, US-based online brokerage Interactive Brokers (Nasdaq: IBKR) has surpassed 1 million active clients across its trading platforms. This is a new record for the 42-year-old company and highlights the success many online brokerages have had this year amid extreme market volatility and disruptions caused by the Covid-19 pandemic.

Among other things the broker reported a 10% drop in daily average revenue trades, or DARTS from 1.953 million in September to 1.762 million in October, signaling a slowdown in trader activity as we approach the US Election, which is taking place today. Nonetheless, the reported DARTS metrics are still 120% better than those achieved in October 2019, signaling the rise in popularity of equities trading in the United States and elsewhere.

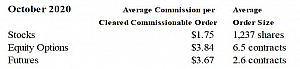

Interestingly, the broker reported that it charged an average of $2.49 in commissions for trade orders, which includes exchange, clearing, and regulatory fees. This indicates that although “commission-free” trading is here to stay for major online equities shops in the United States, their revenue generation is still diverse among other product groups:

Don’t miss the latest news and discussion on our Telegram channel. Subscribe today!

November 2nd, 2020: The Financial Commission today announces that the membership status of Trade99 has ceased following a voluntary withdrawal.

Trade99 had met its obligations as a Financial Commission member up until October 30th, 2020, when its membership was effectively withdrawn.

Financial Commission notes that it will not be able to process any new complaints from Trade99, following its voluntary withdrawal of membership from the Financial Commission as of October 30th, 2020, and moving forward or until membership is approved again.

Furthermore, Trade99 clients will not be eligible for reimbursement from Financial Commission’s compensation fund as a non-member, since the compensation fund can only be used by clients of approved members, and subject to the ruling by our Dispute Resolution Committee. The compensation fund is designed to help protect members’ clients in exceptional cases and is funded by the Financial Commission from a portion of membership dues.

An updated list of current and prior members can be found on FinancialCommission.org, including members that have either been expelled or withdrawn voluntarily.

Financial Commission is a leading independent self-regulatory organization whose members include online brokerages and exchanges, across Forex, CFDs, derivatives and cryptocurrency markets, as well as certified providers and developers of trading platform technology used by members and their end-clients who are retail traders and investors.

Financial Commission requires that member firms strictly adhere to membership rules to maintain good standing on an ongoing basis. To learn more about our membership requirements and certification process, contact us or visit https://financialcommission.org

UK-based online contracts for differences (CFDs) broker Plus500 has published a trading update a few days ago announcing its 3Q 2020 financial performance. The results suggest solid growth year over year, but a slowdown from the record metrics achieved earlier in 2020, as market volatility has subsided from extreme levels.

Revenues generated in the third quarter totaled $216.4 million, a 96% jump as compared with the same quarter of the previous year, but a significant decline from the $316.6 million generated in 1Q 2020 and $249 million in the second quarter. EBITDA during Q3 2020 rose 91% percent year over year to $134.2 million.

The broker’s metrics suggest a slowdown in trader activity and interest in trading as 2020 has progressed. The broker continues to bring on thousands of new traders every quarter, but that number has steadily declined since Q1 2020. Last quarter the brokerage added 46,238 new accounts, which is a 90 increase from the same time last year.

Don’t miss the latest news and discussion on our Telegram channel. Subscribe today!

The Cyprus Securities and Exchange Commission (CySEC) announced today that it has reached a settlement and fine with Key Way Investments Ltd. The company currently maintains a Cyprus Investment Firm (CIF) registration and thus must abide by the regulator’s decision.

The regulator indicated in their notice that the enforcement action stems from “possible violations of The Investment Services and Activities and Regulated Markets Law of 2017(“the Law”). More specifically, the onsite inspection taking place in June 2019 for which the settlement was reached, involved assessing the Company’s compliance.”

As indicated by Finance Magnates, the fine “was for non-compliance with Article 5(1) of the Law, regarding the requirement for CIF authorization and Article 22(1), which concerns certain authorization conditions and organizational requirements with which a CIF is required to comply. CySEC has further explained that the financial penalty was also imposed for non-compliance with other articles that cover multiple regulatory requirements, including conflicts of interest, the information provided to clients, and certified persons.”

The company is expected to correct any issues related to the enforcement action, but clients of the company should be aware of the lapses identified by the regulator in order to ensure their future dealings with the company and personal funds are not at risk.