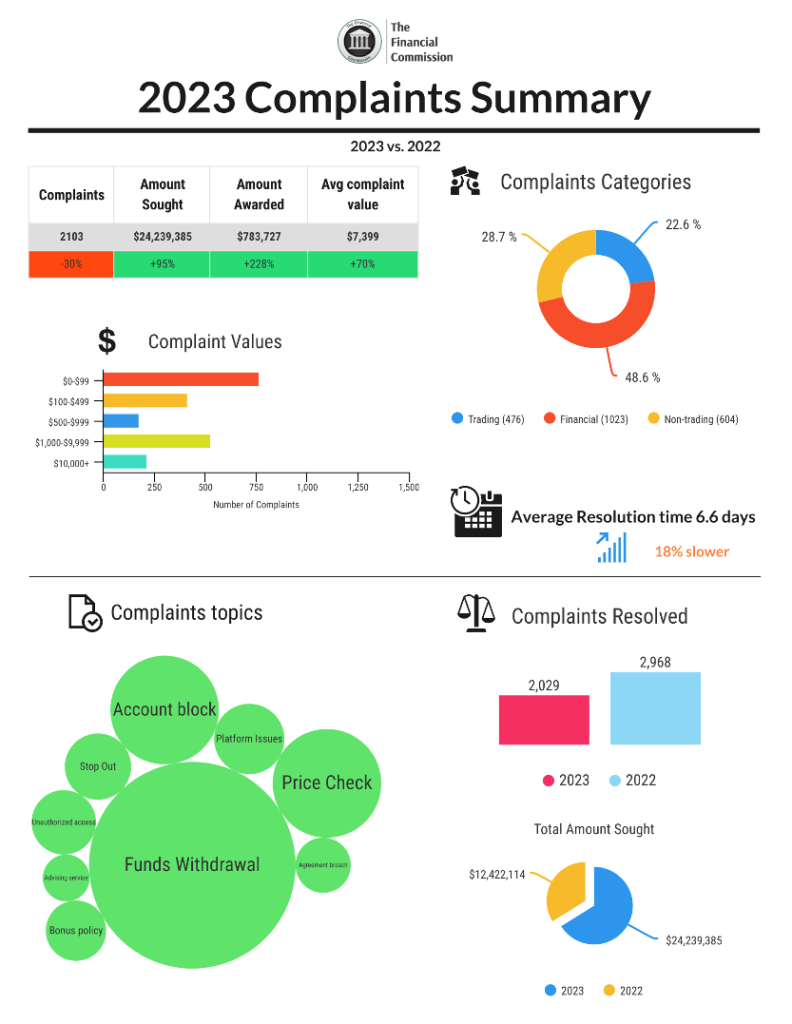

The Financial Commission today announces the results of its operations for the previous year with the publication of the 2023 Complaints Summary. The forum achieved significant growth in several key metrics, including amounts sought, awarded to traders, as well as complaints values during the year, while improvements in streamlining complaints submissions at member firms contributed to a decrease in overall complaints filed and resolved throughout the year.

The forum also continued to bring on new broker members in key regions, as well as protect traders from the continued rise of online scams during a year of mixed market volatility and expanding geopolitical uncertainty.

Key highlights & accomplishments from 2023:

Other key metrics 2023

Annual Complaints Summary

Click here to download

Key Takeaways

Conclusions

The Financial Commission continued to improve its already quick and efficient dispute resolution services for traders and broker members in 2023. Shifting global market price volatility and increased geopolitical uncertainty provided for continued interest in online trading, leading to an increase in the share of trading-related complaints for 2023. Improvements in streamlining complaints submission processes with broker members led to a decrease in overall complaints filed during the year with the share of non-trading complaints falling 65% year over year, helping traders get their disputes resolved quickly by their brokers.

The organization further expanded its membership ranks with new members in the Asia region. The organization’s free dispute resolution service to traders continued to be popular in Asia, with 46% of new complaints coming from this region. Notably, the EDR forum gained popularity in the Middle East, with a 24% share of new complaints, and in Latin America, whose share accounted for 10% of complaints in 2023. The Financial Commission also witnessed a 16% increase in complaints from African countries, as retail trading continues to grow in popularity in this region.

The majority of complaints in 2023 were related to financial issues with 49% of the total, while trading-related disputes accounted for 23% and non-trading-related complaints 29%. The most popular topics for complaints dealt with funds withdrawal (41%), account block (24%), price check (11%), platform issues (5%), and stop-out orders (3%). Of all resolved complaints, 32% were resolved “in favor of the broker” 12% were resolved “in favor of the client”, while 56% were found to be outside the organization’s jurisdiction. The share of complaints resolved in favor of traders was 30% higher than in the previous year.

Heading into 2024, the Financial Commission expects to see continued global demand for trading and investing, particularly among younger traders, with fiscal and geopolitical risks impacting the prices of currencies, and commodities, especially gold and equities through the year. In this regard, the organization is prepared to handle a growing number of complaints from traders during the year.

About Financial Commission

The Financial Commission is an independent external dispute resolution (EDR) organization for consumers/traders who are unable to resolve disputes directly with their financial services providers who are members of the Financial Commission.

The Financial Commission initially set out to provide a new approach for traders and brokers alike to resolve any issues that arise in the course of trading electronic markets such as Foreign Exchange, and then expanded into CFDs and related derivatives, in addition to certifying technology platforms used for trading.

For more information, please contact us at [email protected].

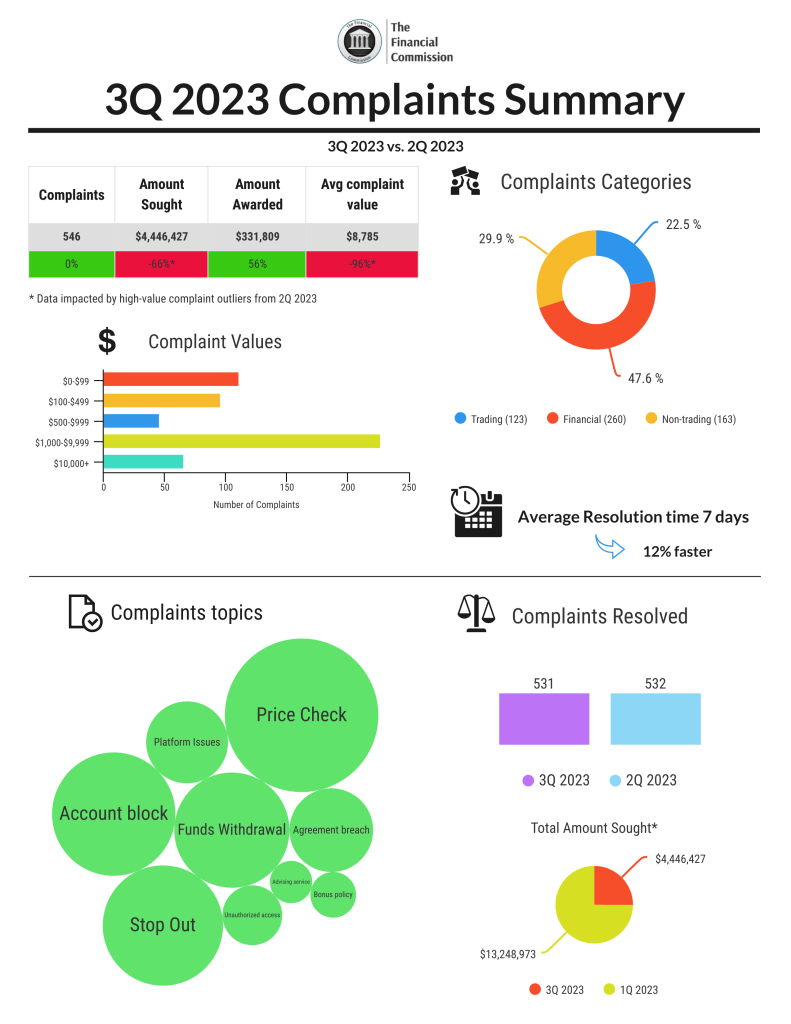

The Financial Commission, a leading independent, non-governmental self-regulatory organization and external dispute resolution (EDR) forum, announces increases in several key operational metrics, including amounts awarded to traders, and trade-related complaints as part of its quarterly Complaints Digest. The organization also recorded quicker dispute resolution times, with complaints being resolved on average in 7.1 days.

As part of its founding core principles to protect traders from possible scams, Ponzi schemes, and fraudulent activities online, The Financial Commission placed 38 websites on its Warning List and identified and issued public warnings regarding clone websites and fake representatives.

Key highlights for 3Q 2023 vs. 2Q 2023:

*Values impacted by several high-value complaints resolved during the previous quarter

Quarterly Comparison

Key Takeaways

Conclusions

The Financial Commission continued to experience a steady influx of complaints from traders amid a continued period of range-bound price volatility and high-interest rates. Specifically, the organization experienced virtually no material change in new complaints filed, as well as in the total number of complaints resolved in the quarter. Nonetheless, complaints amounts sought and awarded, as well as average complaint values changed significantly due to several high-value complaints resolved during the previous quarter. In this regard, the total amounts sought from traders equaled $4.4M for the quarter, 66% lower than 2Q 2023. At the same time, amounts awarded to traders experienced a significant jump to $331,809. Complaints with higher values also experienced significant increases, with complaints valued between $1K-10K jumping 141% QoQ and those valued at $10K+ rising 29%.

There was also a noticeable increase in the complaints topics for the period, with increases in trading-related (7% QoQ) and non-trading-related (4% QoQ) complaints, which indicate that traders are continuing to find trading opportunities, even in possible narrow price ranges in FX and CFD markets.

During the period, the Dispute Resolution Committee (DRC) managed to accumulate 17% fewer complaint investigations carrying over into 3Q, while experiencing an improvement in average resolution times.

About Financial Commission

The Financial Commission is an independent external dispute resolution (EDR) organization for consumers/traders who are unable to resolve disputes directly with their financial services providers who are members of the Financial Commission. The Financial Commission initially set out to provide a new approach for traders and brokers alike to resolve any issues that arise in the course of trading electronic markets such as Foreign Exchange, and then expanded into CFDs and related derivatives, in addition to certifying technology platforms used for trading.

For more information please contact us at [email protected].

July 10th 2023, The Financial Commission, a leading an independent, non-governmental self-regulatory organization and external dispute resolution (EDR) forum, announces increases in several key operational metrics, including amount sought and awarded to traders, trade related complaints and average complaint values, as part of its quarterly Complaints Digest. The organization also recorded slower dispute resolution times, with complaints being resolved on average in 8 days.

As part of its founding core principles to protect traders from possible scams, ponzi schemes and fraudulent activities online, The Financial Commission placed over 45 websites on its Warning List, identified and issued public warnings regarding clone websites and fake representatives.

Key highlights for 2Q 2023 vs.1Q 2023:

*Average complaint values impacted by several high-value complaints resolved during the quarter

Quarter Over Quarter Comparison

Key Takeaways

Conclusions

The continued subduction of market volatility, attributed to the slowing pace and in some cases pauses of interest rate hikes, and inflation globally possibly curtailed retail trading among investors in the second quarter of 2023 and led to changes in several key metrics of The Financial Commission. Specifically, the organization experienced a 3% slowdown QoQ in new complaints filed, as well as a 7% drop in the total number of complaints resolved in the quarter. Nonetheless, complaints amounts sought and awarded, as well average complaint values soared to significantly high levels. While some of the statistics were impacted by several large HNW complaints, the overall increases indicate that complaints submitted to The Financial Commission forum continue to grow in value this year and, evidently, so does the need for unbiased, independent and thorough investigation of such disputes.

There was also a noticeable increase in the complaints topics for the period, with increases in trading-related (6% QoQ) and financial-related (4%) complaints, which indicate that traders are continuing to find trading opportunities, even in possible narrow price ranges in FX and CFD markets.

During the quarter, the Dispute Resolution Committee (DRC) managed to accumulate less complaint investigations carrying over into 2Q, although experiencing an uptick in average resolution times due to the complexity and duration of trading-related complaint investigations during this time.

About Financial Commission

The Financial Commission has conducted dispute resolution services specifically for FX and CFD traders and broker member firms since 2013 as an independent, non-governmental self-regulatory organization and external dispute resolution (EDR) forum. For more information, click here or email us at [email protected].

April 4th 2023, The Financial Commission, a leading external dispute resolution (EDR) organization catering to the financial services industry, announces increases in several key metrics, including new and resolved complaints, amounts sought from non-members and those awarded to traders, as well as rise in financial-related complaints, as part of its quarterly Complaints Digest. The organization also recorded improved resolution times, with complaints being resolved on average in 5.6 days.

Key highlights for 1Q 2023 vs. 4Q 2022:

Quarter Over Quarter Comparison

Key Takeaways

Conclusions

The return of market volatility, as well as sustained macro trends, including rising interest rates, inflation and geopolitical concerns boosted retail trading among investors in the first quarter of 2023 and impacted several key metrics of the Financial Commission. There was also noticeable change in the complaints topics for the period, with increases in trading-related and financial-related complaints, which indicate that traders are back to finding opportunities in the markets. In 1Q 2023 the organization also experienced an increase in amounts sought from non-member firms, indicating the significant number of investors, who do not have access to external dispute resolution (EDR) services today. Complaints filed and resolved in the first quarter of 2023 were also more valuable, with those in the $500-999 and $1,000-9,999 categories increasing 48% and 54%, respectively – highlighting the continued importance of the organization to investigate complaints with higher monetary values. During the quarter, the Dispute Resolution Committee (DRC) managed to accumulate less complaint investigations carrying over into 2Q, while experiencing an improvement in already exceptional average resolution times, which still continue to outpace alternative EDR services.

About Financial Commission

The Financial Commission has conducted dispute resolution services specifically for FX and CFD traders and broker member firms since 2013 as an independent, non-governmental self-regulatory organization and external dispute resolution (EDR) forum. For more information, click here or email us at [email protected].

January 25th, 2023, The Financial Commission today announces the results of its operations for the previous year with the publication of the 2022 Complaints Summary. The organization achieved record annual growth in key metrics, including new complaints filed and resolved during the year, while achieving an all-time record for quickest and efficient average dispute resolution time since 2013. The organization also continued to bring on new broker members in key regions during a year of rising market volatility and geopolitical uncertainty.

New records set in 2022

Other key metrics & accomplishments in 2022

Annual Complaints Summary

Key Takeaways

Conclusions

The Financial Commission improved its already quick and efficient dispute resolution services to traders and broker members in 2022. New global market price volatility and geopolitical uncertainty provided for a renewed interest in online trading, leading to a record amount of new complaints for the organization, as well as improved operational metrics.

The organization further expanded its membership ranks with large, internationally recognized brokers, as well as new members in the Asia region. The organization’s free dispute resolution service to traders gained popularity in Asia, Latin America and Europe with new complaints from these regions growing 47%, 38% and 30% respectively, while complaints from the Middle East grew moderately at 15% in 2022. The Financial Commission also saw a continued decrease of 38% in complaints from Russia and former Soviet republics, as local market restrictions remained in place.

The majority of complaints in 2022 were related to non-trading issues with 58% of the total, while financial related disputes accounted for 29% and trading related complaints 13%. The most popular topics for complaints dealt with account blocking (29%), funds withdrawal (19%), price check (14%), non-market quotes (7%) and stop-out orders (6%). Of all resolved complaints, 42% were resolved “in favor of the broker” and 16% resolved “in favor of the client”, while 52% were found to be outside the organization’s jurisdiction.

Heading into 2023, the Financial Commission expects to see healthy global demand for trading and investing, particularly among younger traders, with fiscal and geopolitical risks impacting the prices of commodities, equities and digital assets through the year. In this regard the organization is prepared to handle a further growth in the number of new complaints from traders during the year.

About Financial Commission

Founded in 2013, the Financial Commission is a leading independent member-driven external dispute resolution (EDR) organization for international online brokerages, exchanges and Blockchain firms that participate in global foreign exchange (forex), derivatives, CFD and digital asset markets.

The Financial Commission provides efficient compliance solutions to its members, alongside its External Dispute Resolution (EDR) mechanism that serves as an effective channel for processing complaints from clients of member firms.

For more information please contact us at [email protected].

January 25th, 2023, The Financial Commission today announces the results of its operations for the previous year with the publication of the 2022 Complaints Summary. The organization achieved record annual growth in key metrics, including new complaints filed and resolved during the year, while achieving an all-time record for quickest and efficient average dispute resolution time since 2013. The organization also continued to bring on new broker members in key regions during a year of rising market volatility and geopolitical uncertainty.

New records set in 2022

Other key metrics & accomplishments in 2022

Annual Complaints Summary

Key Takeaways

Conclusions

The Financial Commission improved its already quick and efficient dispute resolution services to traders and broker members in 2022. New global market price volatility and geopolitical uncertainty provided for a renewed interest in online trading, leading to a record amount of new complaints for the organization, as well as improved operational metrics.

The organization further expanded its membership ranks with large, internationally recognized brokers, as well as new members in the Asia region. The organization’s free dispute resolution service to traders gained popularity in Asia, Latin America and Europe with new complaints from these regions growing 47%, 38% and 30% respectively, while complaints from the Middle East grew moderately at 15% in 2022. The Financial Commission also saw a continued decrease of 38% in complaints from Russia and former Soviet republics, as local market restrictions remained in place.

The majority of complaints in 2022 were related to non-trading issues with 58% of the total, while financial related disputes accounted for 29% and trading related complaints 13%. The most popular topics for complaints dealt with account blocking (29%), funds withdrawal (19%), price check (14%), non-market quotes (7%) and stop-out orders (6%). Of all resolved complaints, 42% were resolved “in favor of the broker” and 16% resolved “in favor of the client”, while 52% were found to be outside the organization’s jurisdiction.

Heading into 2023, the Financial Commission expects to see healthy global demand for trading and investing, particularly among younger traders, with fiscal and geopolitical risks impacting the prices of commodities, equities and digital assets through the year. In this regard the organization is prepared to handle a further growth in the number of new complaints from traders during the year.

About Financial Commission

The Financial Commission has conducted dispute resolution services specifically for FX and CFD traders and broker member firms since 2013 as an independent, non-governmental self-regulatory organization and external dispute resolution (EDR) forum. For more information, click here or email us at [email protected].

January 16th 2023, The Financial Commission today announces increases in several key metrics, including amounts sought from broker members and average complaint values, as well as rise in trading-related complaints as part of its quarterly Complaints Digest. The organization experienced a slowdown in new and resolved complaints, amounts sought from non-member brokers and complaints ruled in favor of traders in the 4th quarter of the year.

Key highlights for 4Q vs. 3Q 2022:

Quarter Over Quarter Comparison

Key Takeaways

Conclusions

Range bound forex and derivatives prices, as well as winter holidays impacted several key metrics of the Financial Commission in the final quarter of 2022. Slowdowns in filed and resolved complaints, as well as compensation sought suggest traders may be finding less opportunities on traditional markets in light of range bound price fluctuations or simply forwent trading at the end of the year. In 4Q 2022 the organization also experienced a drop in most amounts sought metrics, except those attributed to members. There was a noticeable change in the complaints topics for the period, with trading-related complaints rising 5% month-over-month despite the general drop in new complaints for the quarter. Complaints listed in the value category $1-10K and $10K+ increased their overall share of complaints 5%, highlighting the continued importance of the organization to investigate complaints with higher monetary values. During the quarter, the Dispute Resolution Committee (DRC) managed to accumulate less complaint investigations carrying over into the New Year, as compared to 3Q, while experiencing a rise in already exceptional average resolution times, which still continue to outpace alternative EDR services.

About Financial Commission

The Financial Commission has conducted dispute resolution services specifically for FX and CFD traders and broker member firms since 2013 as an independent, non-governmental self-regulatory organization and external dispute resolution (EDR) forum. For more information, click here or email us at [email protected].

October 4th 2022, The Financial Commission today announces increases in several key metrics, including amounts sought and awarded to traders, as well as improved dispute resolution times as part of its quarterly Complaints Digest. The organization experienced a rise in new and resolved complaints, amounts sought from non-member brokers, average complaint values and complaints ruled in favor of traders in the 3rd quarter of the year.

Key highlights for 3Q vs. 2Q 2022:

Quarter Over Quarter Comparison

Key Takeaways

Conclusions

Renewed focus on forex and derivatives trading following weak cryptocurrency prices among investors impacted several key metrics of the Financial Commission in the third quarter of 2022. Renewed growth in filed and resolved complaints, as well as compensation sought suggest traders may be taking advantage of price volatility on traditional markets in light of the negative impact to such asset classes as digital currencies. In 3Q 2022 the organization also experienced growth of all amounts sought metrics, including total amounts sought and those only attributed to members and non-members. There was a significant change in the complaints topics for the period, with financial complaints rising 54% and non-trading complaints falling by 13% of all new complaints for the period. Complaints listed in the value category $1-10K jumped 25%, highlighting the continued importance of the organization to investigate complaints with higher monetary values. During the quarter, the Dispute Resolution Committee (DRC) accumulated more complaint investigations carrying over into 4Q 2022 due to the complex nature of the dispute subjects, while nonetheless improving already exceptional average resolution times, which still continue to outpace alternative EDR services.

About Financial Commission

The Financial Commission has conducted dispute resolution services specifically for FX and CFD traders and broker member firms since 2013 as an independent, non-governmental self-regulatory organization and external dispute resolution (EDR) forum. For more information, click here or email us at [email protected].

July 27th, 2022, The Financial Commission today announces its operating metrics for the first half of 2022 as part of its ongoing Complaints Digest publications highlighting the organization’s performance. Continued interest in trading among investors has led to a steady rise in some key metrics of the dispute resolution service of the organization, while average dispute resolution times continued to improve. The organization also added 6 new broker members and certified one platform provider during this period.

Key Half Year Highlights (as compared to 2H 2021):

A Detailed Summary

Key Takeaways for 1H 2022

Conclusions

The Financial Commission continues to effectively resolve traders’ disputes and public inquiries during continued market volatility around the world, with total resolved complaints for the 1st half of 2022 being 6% higher than 2H 2021. The drop in average complaints values and changes in the complaints value categories suggest that many new investors have entered the market on the heels of significant equity and crypto market growth that occurred in the later stages of 2021.

The Dispute Resolution Committee witnessed a rise in compensation sought from member brokers of 26%, indicating the rise in demand for trading services among Financial Commission members, while also experiencing a drop of 66% in compensation sought from non-members, suggesting that warnings and notices issued regularly by the Financial Commission and financial regulators worldwide may be deterring investors from becoming victims of untrustworthy companies and exchanges.

The continued effectiveness of the dispute resolution service is also highlighted by the 12% rise in member complaints for the half year. “Non-trading related” complaints continue to grow with a 5% uptick to 1112 in this time period, highlighting the broad scope of issues experienced by traders today. The highest trending complaints topics included account blocking, withdrawal of funds and price check requests further highlighting the continued interest in trading FX and CFD markets by traders of all experience levels.

About Financial Commission

The Financial Commission has conducted dispute resolution services specifically for FX and CFD traders and broker member firms since 2013 as an independent, non-governmental self-regulatory organization and external dispute resolution (EDR) forum. For more information, click here or email us at [email protected].

April 20th 2022, The Financial Commission today announces increases in new filed and resolved complaints, as well as amounts sought from broker members as part of its quarterly Complaints Digest. The organization also experienced a slight uptick ini already swift average dispute resolution times, with a 6.3 days average for the quarter.

Key highlights for 1Q 2022:

Quarter Over Quarter Comparison

Key Takeaways

Conclusions

Demand for retail trading continued to impact several key metrics of the Financial Commission in the first quarter of 2022. An increase in newly filed complaints and increases in resolved complaints suggest traders are continuing to try and take advantage of market opportunities with the Dispute Resolution Committee (DRC) continuing to process a significant amount of complaints in the first quarter of the year. The DRC was able to award a smaller amount of compensation to traders than in the previous quarter while experiencing a jump in the amounts sought by traders from broker members during this time. Financial-related complaints increased by 40%, which indicates a significant rise in disputes related to funds withdrawal. At the same time, complaints listed in the most valuable category ($10K+) jumped 70% in 1Q 2022, highlighting the continued importance of the organization to investigate complaints with a significant monetary value. During the quarter, the DRC was able to resolve 3% more complaints than in the previous period with fewer complaint investigations and decisions carried over into 2Q 2022, while maintaining exceptional average resolution times, which still continue to outpace alternative EDR services.

About Financial Commission

The Financial Commission has conducted dispute resolution services specifically for FX and CFD traders and broker member firms since 2013 as an independent, non-governmental self-regulatory organization and external dispute resolution (EDR) forum. For more information, click here or email us at [email protected].

January 17, 2022, The Financial Commission today announces the results of its operations for the previous year with the publication of the 2021 Complaints Summary. The organization achieved record annual growth in key metrics, as well as continued membership expansion during another challenging year impacted by the Covid-19 pandemic while maintaining a quick and efficient average dispute resolution time.

New records set in 2021

Other key metrics & accomplishments in 2021

Annual Complaints Summary

Key Takeaways

Conclusions

The Financial Commission continued to provide quick and efficient dispute resolution services to traders and broker members in 2021 despite continued global disruptions related to Covid-19. Continued demand from retail traders and new investors provided for a record amount of new complaints for the organization and led to new records in operational metrics.

The organization further expanded its membership ranks with large, internationally recognized brokers, as well as new members in the Middle East region. The organization’s free dispute resolution service to traders gained popularity in Asia, Latin America and Europe with new complaints from these regions growing 98%, 87% and 20% respectively, while complaints from the Middle East grew substantially by 357% in 2021. The Financial Commission also saw a continued decrease of 47% in complaints from Russia and former Soviet republics, as local market restrictions continued to impede the normal online trading operations FX and CFD traders had come to expect in the past.

The majority of complaints in 2021 were related to non-trading issues with 58% of the total, while financial related disputes accounted for 23% and trading related complaints 19%. The most popular topics for complaints dealt with account blocking (32%), funds withdrawal (17%), price check (13%), non-market quotes (8%) and stop-out orders (6%). Of all resolved complaints, 59% were resolved “in favour of the broker” and 10% resolved “in favour of the client”, while 30% were found to be outside the organization’s jurisdiction.

Heading into 2022, the Financial Commission expects to see global demand for trading and investing services continue to rise, particularly among younger generations of trades, with opportunities for volatility in prices of financial products, including commodities, energies and equities as a result of changes in fiscal economic policies and impacts from the ongoing Covid-19 pandemic. In this regard, the organization is prepared to handle a growing number of new complaints from traders in the New Year.

About Financial Commission

The Financial Commission has conducted dispute resolution services specifically for FX and CFD traders and broker member firms since 2013 as an independent, non-governmental self-regulatory organization and external dispute resolution (EDR) forum. For more information, click here or email us at [email protected].

January 10th 2022, The Financial Commission today announces increases in amounts sought from brokers and average values of complaints in the last month of the year as part of its monthly Complaints Digest. The organization also experienced a continued improvement in already swift average dispute resolution times, with a 5.3 days average for the month.

Key monthly highlights for December 2021:

Month Over Month Comparison

Key Takeaways

Conclusions

The Financial Commission Dispute Resolution Committee (DRC) did not experience a shortage of complaints heading into the end of 2021 as retail traders continued to find trading opportunities in global markets. The DRC continued to process a significant amount of complaints that grew steadily over the previous months. The DRC was able to award a smaller amount of compensation to traders than in the previous month while experiencing a significant jump in the amounts sought by traders from non-member brokers in December. Roughly 16% of new complaints filed with the DRC in December were valued between $1,000-$10K+, highlighting the continued importance of the organization to investigate complaints with a significant monetary value.

About Financial Commission

The Financial Commission has conducted dispute resolution services specifically for FX and CFD traders and broker member firms since 2013 as an independent, non-governmental self-regulatory organization and external dispute resolution (EDR) forum. For more information, click here or email us at [email protected].

December 8th 2021, The Financial Commission today announces increases in amounts sought from brokers, average values of complaints, as well as total resolved complaints for November 2021 as part of its monthly Complaints Digest. The organization also experienced a significant improvement in already swift average dispute resolution times, with a 6 days average for the month.

Key monthly highlights for November 2021:

Month Over Month Comparison

Key Takeaways

Conclusions

Demand for retail trading continues to impact several key metrics of the Financial Commission for November 2021. Relatively lower numbers for newly filed complaints and increases in resolved complaints suggest traders are continuing to try and take advantage of market opportunities with the Dispute Resolution Committee (DRC) continuing to process a significant amount of complaints in the last quarter of the year. The DRC was able to award a smaller amount of compensation to traders than in the previous month while experiencing a jump in the amounts sought by traders from broker members in November. At the same time, over 22% of all new complaints filed with the DRC in November were valued between $1,000-$10K+, highlighting the continued importance of the organization to investigate complaints with a significant monetary value. During the month, the DRC was able to resolve 2% more complaints than in October with some complaint investigations and decisions carrying over into November, while improving average resolution times, which still continue to outpace alternative EDR services.

About Financial Commission

The Financial Commission has conducted dispute resolution services specifically for FX and CFD traders and broker member firms since 2013 as an independent, non-governmental self-regulatory organization and external dispute resolution (EDR) forum. For more information, click here or email us at [email protected].

November 8th 2021, The Financial Commission today announces increases in amounts awarded to traders, as well as amounts sought from member brokers in October 2021 as part of its monthly Complaints Digest. The organization also experienced a significant improvement in already swift average dispute resolution times, with a 6.8 days average for the month.

Key monthly highlights for October 2021:

Month Over Month Comparison

Key Takeaways

Conclusions

Demand for retail trading and investing looks to be continuing judging by several key metrics of the Financial Commission for October 2021. Steady numbers for filed and resolved complaints suggest traders are continuing to try and take advantage of market opportunities with the Dispute Resolution Committee (DRC) continuing to process a larger number of complaints than in the summer months. The DRC was able to award a larger amount of compensation to traders than in the previous month while experiencing a jump in the amounts sought by traders from broker members in October. At the same time, over 23% of all new complaints filed with the DRC in October were valued between $1,000-$10K+, highlighting the continued importance of the organization to investigate complaints with a significant monetary value. During the month, the DRC was able to resolve 8% fewer complaints than in September with some complaint investigations and decisions carrying over into November, while improving average resolution times, which still continue to outpace alternative EDR services.

About Financial Commission

The Financial Commission has conducted dispute resolution services specifically for FX and CFD traders and broker member firms since 2013 as an independent, non-governmental self-regulatory organization and external dispute resolution (EDR) forum. For more information, click here or email us at [email protected].

October 18th 2021, The Financial Commission today announces increases in newly filed complaints, resolved complaints, as well as amounts sought by traders and average complaints values for September 2021 as part of its monthly Complaints Digest. The organization also experienced a slight slowdown in already swift average dispute resolution times, with 9.4 days average for the month.

Key monthly highlights for September 2021:

Month Over Month Comparison

Key Takeaways

Conclusions

Demand for retail trading and investing looks to have picked up following the summer months as highlighted by the growth of several key metrics of the Financial Commission for September 2021. Increases in new filed and resolved complaints suggest traders are continuing to try and take advantage of market opportunities with the Dispute Resolution Committee (DRC) continuing to process a larger number of complaints than previous months. The DRC was able to award a smaller amount of compensation to traders in the previous month while experiencing a significant jump in the amount sought in all submitted complaints. At the same time, over 23% of all new complaints filed with the DRC in September were valued between $1,000-$10K+, highlighting the continued importance of the organization to investigate complaints with a significant monetary value. During the month, the DRC was able to resolve 33% more complaints than in August with continued operating efficiencies, while the rise in newly filed complaints led to an uptick in average resolution times, which still continue to outpace alternative EDR services.

About Financial Commission

The Financial Commission has conducted dispute resolution services specifically for FX and CFD traders and broker member firms since 2013 as an independent, non-governmental self-regulatory organization and external dispute resolution (EDR) forum. For more information, click here or email us at [email protected].